How to Start a Business: An Entrepreneur’s Guide (2025)

Starting a business has many benefits, but most of all, having the freedom to be your own boss. Nothing beats that! In fact, 47% of entrepreneurs turned entrepreneurs just because they wanted that freedom.

Planning to start a business but don’t know how and where to get started?

This step-by-step guide has got you covered. It covers everything you need to know about starting your own business, from business registration and planning to financing and launching your business.

So, no matter where you stand today, have enough entrepreneurship knowledge or not, we’ll ensure your success in the process.

Are you ready to begin? Let’s dive right in.

What Do You Need to Start a Business?

- Business name: The name will be your company’s official identity on all its legal documents and something that people will refer to it as.

- Business plan: A business document providing all the details about your business, including its history, inception, and financial future.

- Business structure: An independent legal entity established by company founders or directors and owned by shareholders.

- Business registration: A legal proof or credential that your business is legally permitted to operate with state authorities.

- Legal considerations: Your legal considerations include necessary business licenses and permits for regulatory compliance.

- Funding: The sources of funding for your business may include grants, loans, personal savings, or angel investment.

- Marketing plan: This involves the marketing strategies you plan to implement to market and grow your business.

Understand all the things you’ll need to start a business. Let’s head to our guide on starting a business.

The Ultimate Guide to Starting a Business

1. Determine Your Business Concept

You cannot start a new business without a business concept, can you? You need a good, feasible, and profitable business idea or concept to begin with. There’s an age-old myth about business concepts—that you should try making money out of something you love or are passionate about.

It sure sounds lovely to be doing what you love, but you also have to consider the other aspects, like its profitability and whether you’re good at it or not.

For instance, you may love cooking, but how do you plan to be a successful food truck owner if you’re not good at it? This was just a single aspect of it.

you must also consider various others as well. For instance, it won’t make any sense to start a food truck at a crossroads where there are four others already struggling to make profits.

Don’t have a revolutionary business concept in mind? Consider asking yourself some of these questions while brainstorming a business idea.

- What are you really good at?

- What do you like to do the most?

- What are some challenges you face in your day-to-day life?

- Can you come up with a solution for the same?

- Would people pay you for your advice or solution on that matter?

- Is there something you always wanted to do but lacked time and resources?

Answering these questions will pave the way to help you find a business idea or expand on the existing one. Once you have more clarity about your business idea, you can validate it by considering the critical aspects like viability, profitability, and competitive advantages or challenges.

Remember, you don’t need a brand-new or revolutionary idea to start a business. It can be a product or service inspired by a competitor or a better and upgraded version of the existing product available in the market.

There are a few business types in the market, so you may wonder which one of them to consider. Don’t worry; consider the amount of time, money, and other resources required for the business type against what you have—and you’ll have a better picture to see for yourself.

Popular Startup Business Ideas

Here are some of the popular small business ideas for your consideration:

Once you have finalized a business concept, feel free to move ahead to the next step.

2. Market Analysis and Competitor Research

Many entrepreneurs consider their products the most critical thing for their business and there’s no denying it. However, remember that not just any product but the “right product” makes a business successful. And the Market research will help you ensure that the product or solution you intend to develop is the right one.

Let’s take a restaurant, for instance—rather than a fine dining restaurant, a fast-casual restaurant will be a better choice if your location comes across busy streets and is neighboring office spaces. However, the same won’t be the case if you intend to target upscale neighborhoods.

Investors are often curious about what makes people pay you for the solution or what sets your small business apart from the competitors—let’s see how you’d find answers to these and similar other questions.

Market Research

Market research helps you understand your target customers, identify market needs, develop marketing strategies, and maintain a competitive edge. At the primary stage of your research, you would reach out directly to potential customers, gathering information instead of making conclusions based on historical and outdated information.

You may conduct surveys and interviews to learn more about your potential customers and their problems. Your primary research will start with identifying your target customers.

Prepare a questionnaire with relevant questions like their thoughts on the existing products in the market, challenges they face using them in day-to-day life, what differences they’d want the current products to have, and more.

After finishing your primary research, gather information for the secondary research from online resources, census data, and industry reports. Compiling and analyzing this data with your primary research will help you highlight the areas that need attention and build a better product.

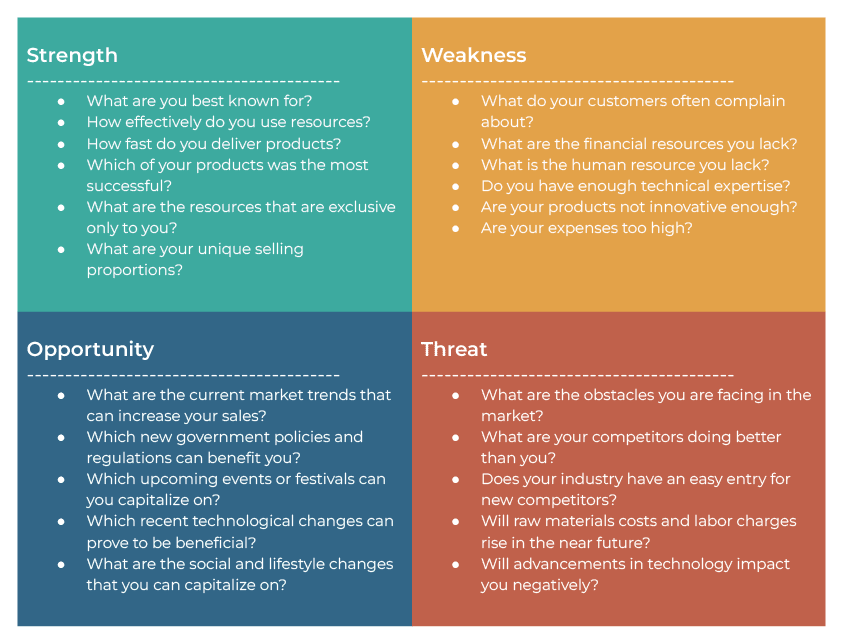

Competitor and SWOT Analysis

SWOT (strengths, weaknesses, opportunities, and threats) analysis helps you oversee how your product would perform against your competitors if taken to the market.

It helps you identify critical facts about your business, including your strengths and weaknesses, while also helping you understand potential opportunities and threats. Here are a few questions to ask yourself while conducting a SWOT analysis:

3. Create a Business Plan

Once you have conducted thorough market and competitor research, it’s time for business planning—the most important step on the entire list. A comprehensive business plan helps you be prepared for every prospect of your business.

This business document will include details about your business, its history, product and service offerings, management, financial health, and more. Although, many consider it just a way to peak investors’ interest, a thoughtful business plan can change the entire course of your small business.

Writing a business document consisting 40-50 odd pages from scratch can be a pain, but a startup business plan template or a business planning software will help you finish your business plan in no time.

Not very good at writing? Need help with your business plan?

Write your business plan 10X faster with Upmetrics AI

Plans starting from $7/month

Business model and exit strategy

Developing a scalable business model and considering an exit strategy are primarily a part of your business plan, something you plan before you start operating. A scalable business model is something that can be replicated easily to serve more customers without having to increase acquisition expenses.

Here are a few scalable business models, you’d like to consider:

- Business franchising

- Subscription business model

- Network marketing businesses

On the other hand, an exit strategy is crucial for businesses seeking funding. It outlines how you will pivot, sell your company, or transfer ownership when taking on other projects.

Some of the common exit strategies include:

- Shutting down the business operations

- Selling out your business to another company

- Liquidating the business assets

- Merger & acquisition deals

Once you have a detailed plan ready for your startup, you may move on to choosing a business structure.

4. Choose a Business Structure

Selecting the right type of legal structure is an essential step in your business formation process since it directly impacts your daily business operations, the amount of taxes you owe, or whether your personal assets are at risk.

Understanding the different types of these business structures and their advantages and disadvantages will help you select the most ideal one for your small business.

Let’s understand the types of these legal business entities, and their pros and cons:

Limited Liability Company (LLC):

LLC is a legal structure that protects from company debts and liabilities. A business formed as an LLC can be owned by one or more people or companies, and they are referred to as members. An LLC compulsorily requires a registered agent to form.

Pros

- Liability protection for owners

- Easy legal entity to set up

- You can form a one-member LLC

Cons

- LLCs can’t issue stocks

- Annual filing fees by the state

- Additional paperwork with the state

Limited Liability Partnership (LLP):

LLPs are flexible legal and tax entities that limit a general partner’s liability and protect them from unlimited liability. This business entity is common and popular amongst businesses like law firms, accounting firms, and wealth managers.

Pros

- Less paperwork and easy to form

- Limited Liability for partners

- No limit to the number of partners

Cons

- All partners are liable for any malpractice claims against the LLP.

- Active partner involvement required

Sole Proprietorship:

Sole proprietorship is the simplest and easiest business entity to form if you are a solo business owner. You, the company owner, and the company are considered the same for legal and tax purposes, making you solely responsible for business debts.

Pros

- Sole proprietorship is less expensive and easy to form

- no extra paperwork with the state

- The owner holds 100% ownership and control of the firm

Cons

- Difficult to raise capital

- Business continuity or operations are tied to the life of the owner

- The owner is personally responsible for business debts and legal actions

General Partnership:

A General partnership is a business entity where two or more individuals agree to share assets, profits, responsibilities, and financial and legal liabilities of a jointly-owned business. It’s necessary for partners to create a partnership agreement in a general partnership.

Pros

- Less expensive and easy to form

- Direct profit distribution among

- Ppass through taxation

Cons

- Unlimited personal liability

- Difficult to raise capital

- Potential for disputes.

Corporation:

A corporation is a legal business entity that is separate and distinct from its owners. Its shareholders are owners of the company, but not responsible for the company’s debts. An individual or a group of people can create or form a corporation.

Pros

- Liability protection for the owners

- Unlimited number of shareholders

- Lifespan is not limited

Cons

- LLCs can’t issue stocks

- Annual filing fees by the state

- Additional paperwork with the state

Hope you have all the information required for selecting a business entity. Still confused? Refer to this featured resource before you go to the next step.

5. Select a Business Location

Your business startup costs, registration process, and legal requirements heavily rely on your business location. So it’s crucial to select your business location wisely. You may ask yourself a few questions like these while determining a business location.

- Do your customers visit your office/store?

- How many employees do you plan to hire?

- How much competition is there in the area?

- Will your business have a physical location or it will operate online?

You may also consider checking zoning regulations and other expenses related to business location before finalizing it.

Looking for a curated guide to starting a business in your state? Explore our state-specific business startup guides with the exact steps, registration process, and fee structure.

6. Register Your Business

Starting a business involves addressing some legal issues and a lot of paperwork. The legal documentation and business registration process may vary depending on the state in which you plan to operate. Still, consider the following steps to get off the mark.

Select a business name

You cannot start a new business without a name for people to call it by. Find a unique and catchy business name that’s easy to pronounce and remember. Find the best available domain name, preferably with the “.com” extension.

Remember, your business name cannot be the same as another registered business in your state, nor can it be the same as another service or trademark mark registered with the United States Patent and Trademark Office (USPTO).

Furthermore, you should also consider if you want a DBA (Doing Business As) or a fictitious name. It is required when you operate with a different name from your legal business name.

For instance, Joe’s Pizza House is your legal business name, but you may want to go by the name—Joe’s Pizzeria; that’s a DBA for you. You may file for a DBA with your state, city, or country’s government offices.

Register your business and obtain an EIN

Once you have a registered business name and a DBA, you may start the official business registration process. Since we’ve already discussed the business entity types, you may begin with filing forms for the chosen business entity with your secretary of state’s office.

You’ll also need to hire a registered agent as a part of the process to receive legal documents and respond to them on behalf of the company.

Finish the legal work and documentation, and the secretary of state’s office will send you the business registration certificate to apply for professional licenses and the tax identification number.

Next—apply for an Employer Identification Number through the IRS portal. A federal employer identification number is a must for your business to hire employees or be taxed separately.

7. Get the Necessary Licenses and Permits

Every business has its distinct license and permit requirements. For instance, a wine bar would require a liquor license, a trucking business would require a commercial driver’s license, and, on the other hand, a fine dining restaurant would need health inspections to operate legally.

Furthermore, your business city or state may also require a certain business license irrespective of its industry or field. If renovating a space as a storefront to sell products, you may have to ask local officials for the zoning considerations.

Sounds overwhelming? Don’t worry, set some time aside to identify your license and permit requirements, industry and local business associations like the Chamber Of Commerce would certainly be of help.

Some must-have business licenses and permit types include:

- Federal license—regulated by the federal agency

- State-level licenses—regulated by the State agency

- Local business license—regulated by local county or city clerk’s office

- Professional business license—for businesses that require special training

All clear? Let’s continue to the next one.

8. Open a Business Bank Account and Credit Cards

Since we have covered the registration part, it’s time to get your finances in order. Irrespective of what business entity you have chosen for your company, you need to keep your business expenses separate from your costs.

You will need to provide your business name and EIN when you open a business bank account. Having a business bank account will not only help you separate your finances but will also help in keeping track of your business transactions, such as invoicing customers and paying suppliers.

On the other hand, a business credit card can do more than just separate your personal and business expenses. It will help you build a strong credit history that will eventually help in raising capital and getting bank loans.

9. Determine Financing Requirements

The next step on the line is—determining your financing requirements. You must have a brief understanding of your startup and operational costs. You can estimate your startup costs by listing down the essential startup supplies, licensing requirements, office space, and associated expenses.

As shown in the example below, you can list your startup expenses:

| Common Startup Costs | Pricing range |

|---|---|

| Equipment and tools | $5,000 to $120,000 |

| Incorporation fees | $100 to $725 |

| Office or workspace | $200 to $1500 per employee/month |

| Legal and professional fees | $4,000 to $12,000 per year |

| Business licenses and permits | $1,000 to $5,000 |

For instance, starting a small bakery costs around $26,600 to $36,700. Similarly, estimate the startup costs for your small business. This will allow you to understand how much funding your business will need to get going.

10. Fund Your Business

If you’ve followed the previous steps and created a solid business plan, you’ll have a clear understanding of your financing requirements. There are multiple ways to fund your business depending on the amount and type of funding required.

There are two types of funding options for small business owners—internal and external. The internal funding options include personal savings, credit cards, and money borrowed from family and friends.

While these are easier to obtain, you may lose a chunk of your wealth or put the money invested by your family and friends at risk if your business fails. So, it’s wise to consider the external funding options. Those include:

- Small business loans

- Small business grants

- Venture capital

- Angel investors

- Crowdfunding

Some businesses consider a combination of funding sources. You may determine the most preferable one for you depending on your requirements, and the amount of time you’d need to repay.

Make sure you are not borrowing more than you need or can pay back. You’re just starting out, and you’d definitely want to keep things under control.

11. Get Business Insurance

Having reliable business insurance is a must. No matter if you operate from home, office, or the mount Everest. Your business insurance will not only offer protection against financial losses, but also help you efficiently manage risks, and focus on growing your company.

The type of business license you’ll need will depend on your business model and the risks involved around it. So you might need one or multiple insurance policies considering the coverage requirements.

Let’s discuss the basic types of business insurance coverage.

- General Liability insurance is a must-have insurance for all businesses that protects against third-party claims of property damage and personal and bodily injuries.

- Worker’s compensation insurance is a necessary coverage for businesses with employees that covers medical expenses and income replacements for employees injured on the job.

- Professional liability insurance is a must-have coverage for businesses providing consulting services.

- Property insurance offers protection against damage to the physical assets of your business, including office space, inventory, equipment, and others.

- Product liability insurance offers protection against claims that your product caused property damage or bodily injuries.

These are some of the basic and popular business insurance coverage types, you may consult an insurance agent to learn more about business insurance and what coverage policies you should consider for your business.

12. Get the Necessary Software and Tools

Running a successful business today, is way different than what it used to be a few decades ago. There are tools for everything.

These software and AI tools for small businesses help streamline your business operations, save manpower and resources, and get things done faster than before.

So let’s see what necessary software and tools you’ll need in your arsenal moving forward.

- AI business plan generator: Using an AI tool like Upmetrics is an easier way to create a business plan with AI writing and financial forecasting assistance.

- Accounting software: To help you track your business income and expenses, our recommended accounting software include QuickBooks and Xero.

- Point of Sale (POS): A POS system allows you to process customer payments. Many accounting and CRM software like Clover and Lightspeed include built-in POS features.

- Project management software: A necessary software to plan, execute, and manage projects and employee tasks, our recommendations—ClickUp and Asana.

- Payroll software: It is a must-have for and employee payroll, our recommendations—Gusto, Onpay, Paychex.

- Customer Relationship Management (CRM): It will help you manage customer relations, keep track of sales and marketing data, and automate tasks. recommendations—HubSpot and Zoho.

These are some of the basic software you’d need starting off. You may also consider some others depending on your operational requirements.

13. Market Your Business

Planning? Check. Registration? Check. Funding? Check. We covered all that is required to start a business; just a thing is remaining—a well-thought-out marketing plan. Let’s discuss the marketing of your business.

Set Up a Business Website

Whether you plan to operate a brick-and-mortar or an online business, having an online presence is a must for every small business owner. You build your website using website builders like 10Web, Wix and Squarespace or hire a freelance developer to do it for you.

Create a Google Business Profile

A well-optimized Google Business Profile can help you with local SEO. Your customers may use it to write or read reviews, find location details, seek contact information, and more. The best thing about it is—it’s free to create.

SEO and Content Marketing

Once you’ve set up your company website or e-commerce store, optimize it for SEO. SEO content marketing will help users find your business using related search queries. Content marketing is a long-term game; you may not see a thousand people visiting your site initially, but it’s all worth it in the long run.

Develop a Social Media Strategy

Almost every one of your potential customers has a smartphone with social media apps installed in it. They are on social media, and you should be there, too. Develop a social media strategy and use social media to drive traffic to your website.

You don’t need to be on all the social media platforms; research what platforms your potential customers use and plan your strategies around those platforms.

14. Build a Team

You can start a business alone, but you will need a strong team by your side to help you grow. Initially, you don’t need to hire employees for each role.

Establish a core team to manage critical responsibilities and collaborate with contractors and freelancers for less important tasks. You can always hire more employees as your business grows.

Here are a few resources to help you hire staff, contractors, and freelancers:

- Freelancer platforms: Consider using freelance platforms like Upwork, Freelancer, and Fiverr to hire contractors and freelancers.

- Job boards: Job boards like Indeed and Craiglist allow you to job posts for open positions at your company. They’re mostly free to use.

- Hiring platforms: Hiring platforms like Glassdoor allow you to post job descriptions and conduct video interviews.

- Social media: You may also consider using social media platforms like Linkedin to reach out to professionals looking for a change.

Let’s head to our last step. It’s time to launch your business.

15. Launch and Scale Your Business

If you closely follow all the steps mentioned in this guide, you will have a business launched successfully. However, some extra steps and efforts are necessary to scale and make it big.

These include collaborating with other local businesses, expanding your product line, optimizing your marketing efforts, and others. These are just examples; how you should plan to scale your business totally depends on your business.

For instance, if you own a travel agency, you may consider partnering with other related businesses like restaurants, hotels, cab businesses, etc.

Remember, no matter how you plan to do it, the ultimate goal remains the same—growing the customer base and increasing revenue.

It sure is crucial to scale, but don’t forget to keep other aspects in check while you do. For instance, keep an eye on the amount you spend on marketing efforts or scaling your business and how it’s affecting your profits. Revenue of a million dollars makes no sense if you take home a few thousand dollars.

The step-by-step guide ends here with the last step. Here are a few resources to help you get going, before we say adieu.

Resources to Start a Business

Upmetrics is more than just a business planning software. Here are some of our well-curated resources to help on your new business journey.

- Free business plan generator: It helps you create a lean business plan before you create a comprehensive and detained one.

- Library of 400+ sample business plans: A well-curated library of 400+ industry-specific business plan examples for your inspiration.

- Free small business tools: A set of free business tools with AI-powered features for small business owners. i.e. SWOT analysis generator, Competitor analysis generator.

- Investor pitch template: An investor pitch template to help you structure your pitch and prepare for investor meetings.

- Marketing plan template: It will help you create a well-thought-out marketing plan to market and grow your business.

- Free business calculators: These business calculators make complex business calculations like startup costs, current ratio, and after-tax cost debt, making it as easy as calculating at your fingertips.

Conclusion

That was the ultimate business startup guide for you. Here’s the recap for you—start with identifying the business concept, then conduct market research, write a business plan, select a business entity, and register your business.

Remember, completing the registration isn’t the end of the process but the beginning of your business journey; get your finances in order, get the necessary software, bring in a collaborative team, and get ready for the big launch.

Follow these steps and you have a successful business up and running.

You’ve got everything now! What are you waiting for? Let’s start by putting your business idea to paper—create a business plan and turn your business idea into reality.

Frequently Asked Questions

What is the ideal business structure for entrepreneurs?

It’s difficult to claim an ideal business structure for entrepreneurs since it depends on various factors such as the business type, number of business owners, tax implications, and liability concerns. However, It is believed, that sole proprietorships or LLCs are the best choices for many business owners.

Do I need a business degree to start a business?

No, you do not need any business degree or diploma to start a small business. However, you may require necessary business licenses and educational qualifications specific to your business and your role in the operations.

How much does it cost to start a business?

The cost of starting your own business depends on various factors like the business model, location, and industry. However, Guidant Financial’s 2023 survey reported that the average cost of starting a small business falls between $50K and $1 million.

What would be the easiest business to start?

Starting a business requires thorough planning and sheer hard work, there’s no easy way out. However, following are the some easiest businesses to start: online tutoring, freelancing, pet sitting, and virtual assistance.

Can I start a business with no money?

Indeed. You can start a small business with little or no money, but it requires a willingness to put in some extra effort. You may reach out to your friends, family, angel investors, and venture capitalists seeking funding for your business idea.

About the Author

Vinay Kevadiya

Vinay Kevadiya is the founder and CEO of Upmetrics, the #1 business planning software. His ultimate goal with Upmetrics is to revolutionize how entrepreneurs create, manage, and execute their business plans. He enjoys sharing his insights on business planning and other relevant topics through his articles and blog posts. Read more

Get started with Upmetrics Al

- 400+ sample business plans

- Al-powered financial planning

- Collaborative workspace