I’ve worked with founders at every stage—from first-time entrepreneurs to growing businesses preparing for investors or loans. Many assume one traditional plan can work for everything—pitching investors, applying for loans, or guiding the team, but that’s not true.

Each goal needs a different approach, a different level of detail, and a different audience in mind.

That’s why we put this piece together to simplify the process and help you understand the main types of business plans, when to use each, and how to choose the one that actually fits your goals.

What’s the point of different business plans?

It’s a fair ask. Every plan covers similar ground—goals, strategy, numbers—but its purpose and audience shape how it’s written. That’s what makes business planning flexible.

Think about it. Are you

- Just starting? You don’t need a 40-page document. Just a quick, adaptable plan that helps you test ideas and refine your model.

- Raising funds? Your plan has to do more than describe your business; it has to persuade. Investors expect a story backed by data and a clear growth path.

- Already established? Your plan becomes a strategic tool that keeps your team aligned and guides long-term decisions.

There’s no single “right” business plan. The one that fits your current stage, purpose, and audience is the one.

Types of business plans

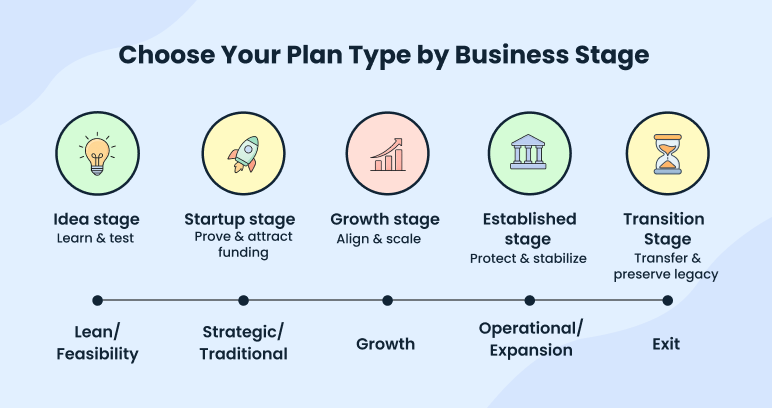

I’ve grouped these plans by business stage in the same way I guide founders who are at different points in their journey. At the start, planning is about clarity. As you grow, it’s about proving the model works. Eventually, it becomes about alignment and long-term direction.

So let’s start from the top.

Idea stage

In this stage, you need a tool that facilitates rapid testing and clear thinking. Why? Because you’re still refining your idea, assessing its feasibility, and determining the actual problem you’d like to solve. At this point, the following plans are the most effective:

1) One-page business plan

| Typical length | 1 page |

| Who is it for? | Founders, small teams, or internal stakeholders. |

| Purpose | To summarize the business idea, target audience, and short-term goals at a glance. |

A one-page business plan is a condensed version of a traditional plan that captures your goals, audience, and business model on a single page. It’s meant for the stage when you’re still shaping your idea and need clarity, not a full document.

At this point, most founders aren’t writing it for investors or banks; they’re writing it for themselves or their team. A one-page plan works as an internal tool for quick alignment and strategic planning. It helps you stay focused on what matters. And because it’s short, you can update whenever your assumptions change.

Your one-page plan will include the essentials like: Your mission, target market, product or service, pricing, short-term goals, and milestones. Feels too brief? Well, that’s the point. A one-page plan works because it moves as fast as your idea does. Once you find your footing, that same page becomes the foundation for expanding into a lean or traditional business plan.

2) Lean business plan

| Typical length | 3-5 pages |

| Who is it for? | Founders, small teams, or internal stakeholders. |

| Purpose | To summarize the business idea, target audience, and short-term goals at a glance. |

A lean business plan builds on the one-page format but adds structure so it works as an active tool. It keeps things short and flexible while turning your ideas into measurable actions and results.

Instead of writing a long document, you use this plan to test assumptions, track what’s working, and adjust quickly when something doesn’t. Every update brings you closer to what your business model should actually look like.

This approach works best for founders who’ve moved beyond the idea stage and are now refining pricing, validating markets, or exploring early funding. Because it’s brief, you can update it often and make decisions based on what your latest data tells you.

A lean plan usually runs three to five pages and covers the essentials: Business model, target market, pricing strategy, cost structure, mission, milestones, and key metrics.

The best part? It evolves with you. As your business grows and gains traction, that same lean plan naturally turns into a more traditional business plan—already grounded in data, feedback, and real results.

Struggling with writing a business plan?

Write your business plans 2x faster with Upmetrics

3) Feasibility business plan

| Typical length | 10–15 pages (approximately) |

| Who is it for? | Entrepreneurs, potential investors, management, and stakeholders. |

| Purpose | To assess whether a proposed idea or project is viable before investing heavily in it. |

A feasibility business plan is a short, research-driven plan that helps you determine whether your business idea is practical, profitable, and worth pursuing before you commit serious time or money.

This document answers three questions: Is the problem real, does the market exist, and do the numbers add up?

The focus here is validation. Instead of trying to convince investors, you’re proving to yourself whether the idea deserves more investment. This plan fits best for founders still exploring, like people testing a new product line, service, or business concept, and need clarity before moving ahead.

A typical feasibility plan runs five to ten pages and covers your market overview, cost and pricing assumptions, early financial projections, and potential risks.

It differs from a traditional or lean plan because it doesn’t describe how to operate or scale; it tells you whether to move forward at all.

Startup stage

Your startup has already passed the “does it work?” stage; now it’s time to generate traction and demonstrate that you can scale.

You require a strategy that’s more detailed in the aspects of strategy, funding, and implementation. Business plans tailored to this stage determine how the business will actually be run, what it requires, and what it will produce a steady stream of income.

The following are the best business plans that can be used at this stage:

4) Startup business plan

| Typical length | 10-15 pages |

| Who is it for? | Founders, early investors, incubators, or lenders. |

| Purpose | To define the business model, operations, and financial strategy for launch and traction. |

A startup business plan is a comprehensive doc outlining your ideas and strategies for launching, operating, managing, and eventually exiting your new business.

At this stage, you’ve moved past brainstorming and are starting to make decisions about who your customers are, how you’ll reach them, and what your path to revenue looks like. So you don’t need a 40-page report, but something more concrete than bullet points on a napkin (10-to 15 pages).

A good startup business plan focuses on clarity over formality. It explains your business model, outlines early financials, identifies competitors, and sets measurable goals. Think of it as a working plan—something you’ll use to test, pivot, and refine as you grow.

Your startup plan should cover the basics:

- Your mission and problem statement

- Target market and customer segments

- Solution (product or service)

- Business model and pricing

- Go-to-market strategy

- Cost estimates and revenue projections

- Key milestones and success metrics

The goal of this plan is to get your thoughts out of your head and onto paper so you can make smarter, faster decisions. And as your startup gains traction, this plan naturally evolves into a full-scale business plan for investors or lenders.

5) Traditional business plan

| Typical length | 15–40 pages |

| Who is it for? | Banks, investors, or grant providers |

| Purpose | To provide a comprehensive overview of the business, market, and financial performance. |

A traditional business plan is a detailed, comprehensive document that serves as a roadmap for a company. It’s often required when you have to raise funds or make a formal business presentation for an investor, a lender, or a grant provider.

The plan is most effective for founders with early traction and growth who need to demonstrate that their business model can be sustained. It’s very formal, data-based, and it’s in a structured format to satisfy the expectations of any professional (like investors and banks).

Traditional plans are usually 20-40 pages long and include all the core sections:

- Executive summary

- Company overview

- Market and competitor analysis

- Marketing and sales strategy

- Operations plan

- Management structure

- Financial projections.

Founders get skeptical about creating a traditional plan if they already have a startup plan they have already built. The difference lies in intent. A startup plan helps you stay focused; a traditional plan helps others believe in your focus.

Feeling stuck writing your business plan?

Upmetrics helps you build it faster and better

Plans starting from $14/month

6) Investor/External business plan

| Typical length | 20–30 pages |

| Who is it for? | Angel investors, venture capital firms, or strategic partners. |

| Purpose | To demonstrate market potential, scalability, and return on investment. |

An investor or external business plan is a detailed roadmap designed to earn belief. It describes what your business does and why it can grow, compete, and deliver a real return. Its purpose is simple: Credibility.

This plan is effective when the fundraiser or founder is presenting to venture capitalists, angel investors, or strategic partners. These readers think in terms of risk and reward, so your job is to connect your vision to financial logic they can trust.

It’s an official, highly factual report, typically 20 to 30 pages. Not too long to give depth and not too long to sensationalize the reader. That is why the majority of investor plans consist of market validation, market analysis, traction measure, growth plan, in-depth financial forecast, and a concise picture of your team.

Take Figma’s early pitch. Their founders led with a gap. Design tools were fragmented, collaboration was broken, and the market was ready for something browser-based. By the time they showed early traction and user feedback, the story and the numbers lined up. That’s what a business plan for investors does: It aligns the story and the numbers so they reinforce each other.

7) Loan or SBA business plan

| Typical length | 20–25 pages |

| Who is it for? | Banks, SBA lenders, or credit institutions. |

| Purpose | To prove repayment capacity, financial stability, and responsible debt management. |

A loan or SBA business plan is a specialized version of the traditional business plan, created for lenders, especially SBA-backed programs. It follows the same structure but focuses on one goal: Proving that your business is financially stable, creditworthy, and capable of managing debt responsibly.

Its purpose is to meet the formal requirements of a loan application and assure lenders of three things:

- You can repay the loan

- Sustain consistent revenue

- And use funds for SBA-approved purposes

This plan is formal and data-driven and is usually 20 to 25 pages long; this is ideal when the founders are trying to raise money. It also contains detailed financial reports in terms of cash flow projections, loan schedules, debt coverage ratios, and working capital projections, and a clear method of how the funds will be used and managed.

Unlike investor plans that sell potential, this one proves reliability. It’s your financial credibility test, and if you’re preparing to apply, our guide on how to write a business plan for a loan can help.

Growth stage

By the time your company reaches the growth stage, it must have found its rhythm, clients are rolling in, your sales will be steady, and your business plan is working.

However, expansion is also accompanied by additional challenges, including how to increase cash flow management, how to create demand-driven systems, and how to retain team cohesion as the operations expand.

Thus, at this point, the following kinds of business plans are the most effective:

8) Operational (Internal) business plan

| Typical length | 10-15 pages |

| Who is it for? | Department heads, managers, and internal teams |

| Purpose | To align day-to-day operations, responsibilities, and performance metrics. |

An operational business plan lays out how your business actually runs every day. It’s the plan that turns ideas into systems: Who does what, when it happens, and how progress gets tracked.

I see founders use it once things start to grow and moving parts multiply. The early hustle starts giving way to teams, budgets, and timelines, and you need structure to keep everyone aligned. This plan helps you do that. It keeps your goals visible, your priorities clear, and your people accountable.

It usually includes quarterly or annual targets, staffing plans, operating budgets, and key metrics that show whether you’re on track. You could think of it as your team’s operating rhythm in written form.

The truth is, smooth operations don’t stay smooth on their own. As growth adds layers, clarity tends to fade. An operational plan pulls it back, keeping everyone moving in the same direction, even when the business gets busy.

9) Strategic business plan

| Typical length | 15–25 pages |

| Who is it for? | Leadership teams, boards, or senior management. |

| Purpose | To connect long-term objectives with strategies, resources, and measurable outcomes. |

A strategic business plan is what you develop when your business is no longer in the day-to-day routine and you are now thinking of the long run. It determines your direction, the things that will make you stay competitive, and how each major step you make correlates with your larger picture.

This is meant to instigate attention and focus. It is easy to pursue all opportunities when growth comes up. This plan makes you step back and choose what matters and focus the whole company on a few things that you are deliberate about.

It best suits leadership teams in an established or fast-growing company that would achieve expansion not by responding to market forces, but with a purpose.

The length of most strategic plans is between 15 and 25 pages, though not too long-winded to tell us why you are making the big moves, yet not too long-winded to make it hard to make decisions.

This is a high-level plan. It doesn’t get into how it operates on a day-to-day basis; it relates your mission, goals, market knowledge, and major initiatives in one direction in which to execute.

A good strategic plan consists of the vision and mission of your company, long-term goals, top competitors, key initiatives, market positioning, resource priorities, and measurable results.

10) Expansion business plan

| Typical length | 10–20 pages |

| Who is it for? | Executives, investors, and growth teams. |

| Purpose | To plan expansion strategies, required funding, and operational adjustments for growth. |

A growth or expansion business plan is an explanation of how a business that is already functioning will make its next giant step, either by entering new markets, introducing new products, or opening new locations. It’s not a matter of having to start out fresh, but expansions of what is already known to work.

The purpose is control through clarity. Growth brings complexity with new teams, new costs, and new risks, and this plan helps you manage all of it with structure. So it’s best suited for established businesses ready to grow intentionally rather than reactively.

Most expansion plans are 10–20 pages long, detailed enough to guide major moves but flexible enough to adjust as the market responds.

It contains:

- Market research

- Growth plan

- Revised financial projections

- Operational changes

- Resource needs

- Risk management processes

And is associated with quantifiable results.

A great example is Airbnb’s expansion beyond short-term stays into long-term rentals and experiences. Their plan connected data, partnerships, and brand alignment so the business could evolve without losing what made it work in the first place.

Established/Specialized stages

This stage is about intention. The emphasis changes from growth to stability, defending success while strategizing for the future. That may be starting a nonprofit venture, making preparations for transitioning leadership, or developing contingency plans to deal with uncertainty.

These are the kinds of business plans that are most effective now:

11) Nonprofit business plan

| Typical length | 10-20 pages |

| Who is it for? | Donors, grant agencies, and nonprofit boards. |

| Purpose | To show how programs, funding, and operations align to create measurable impact. |

A nonprofit business plan is a strategic roadmap for a non-profit that explains how your organization will transform purpose into measurable impact. It links your mission, funding, and operations in such a way that you can keep on track with your cause and, at the same time, have the means to survive.

It keeps the teams focused, and it assures followers that their efforts are bearing visible fruit.

The majority of nonprofit business plans are between 10 and 25 pages because they are detailed enough to convey the goals and budgets, but they are also basic enough to revise as things change.

It typically consists of your mission statement, core programs, source of revenue, fundraising strategy, as well as your staffing plan, budget, and measurable impact objectives, all linked to your purpose.

12) Contingency business plan

| Typical length | 5-10 pages |

| Who is it for? | Leadership, crisis management teams, and key departments. |

| Purpose | To outline backup procedures, communication flow, and response actions for emergencies. |

A contingency business plan is an explanation of how your business will react in case of unfavorable surprises in the running of the business. It’s your safety net applied when stability is threatened by factors like a supply chain delay, a cyberattack, or a funding shortfall.

The plan outlines the party that leads, the method of decision-making, and the priorities that are given to ensure the business operates smoothly. It secures such essential functions as staffing, finance, and logistics, where regular operations are unable to.

It’s particularly ideal with an established or a risk-sensitive company, where a single disruption may cause a domino effect.

Most contingency plans are brief, 5 to 10 pages, action-oriented, as opposed to theoretical. They involve a risk overview, chain of command, flow of communication, steps towards recovery, and backup procedures.

13) Exit/Succession business plan

| Typical length | 10–20 pages |

| Who is it for? | Founders, boards, investors, and successors. |

| Purpose | To ensure a smooth leadership transition and preserve the company’s stability and value. |

The succession or exit business plan makes a company ready to change leadership or ownership. It’s s a long-term strategy that guarantees continuity of operations, culture, and value even after the departure of founders or other important leaders.

This strategy is widely used with well-established companies that are planning to sell, merge, or change hands to a new generation. It provides the process of transfer of ownership, training of successors, and transfers of essential knowledge, finances, and partnerships without interruptions.

A succession or exit business plan is 10–20 pages and cover leadership development, governance structure, transition timeline, and communication strategy.

My overall take: The best business plans don’t stay in their lanes. A founder might start with a lean plan to test an idea, then shape it into an investor version once traction kicks in. Or an operational plan might quietly evolve into a strategic one as the team grows.

That’s not confusion. Your plan should evolve with your business, not trail behind it. The smartest founders don’t rewrite from scratch; they adapt, refine, and keep their plans alive as their goals change.

How to choose the right business plan type?

I would tell you to step back and think before deciding how to use the format. There is a purpose behind any plan, and the most appropriate plan will be different according to your purpose, stage, and target audience.

Personally, I believe that clarity precedes structure. It is so easy to open an AI tool or a blank document and begin to write, so it is like creating a house without being aware of what type you require. The writing becomes far easier as soon as you are aware of the plan of action.

Here’s how that choice usually plays out:

Idea stage → Your goal is to learn. You’re still testing whether the idea works and if there’s a real market for it. A lean or feasibility business plan fits best—short, flexible, and designed to evolve quickly.

Startup stage → The goal now is proof. You’re showing that your business can run, scale, and attract funding. A startup or traditional business plan gives investors and lenders the clarity they need to trust your numbers.

Growth stage → Planning becomes about alignment. As teams expand and decisions speed up, operational, strategic, or expansion business plans help keep direction, budgets, and execution on track.

Established stage → The focus shifts to protection. You’re managing risk, maintaining stability, and planning for uncertainty. A nonprofit, loan/SBA, or contingency plan helps ensure continuity when things change.

Transition stage → Eventually, it’s about legacy. When leadership or ownership shifts, an exit or succession plan helps preserve value and continuity.

How does the business plan structure change (or not)

Regardless of the kind of business plan you are writing, the structure remains relatively similar; only the depth and purpose vary.

All plans still comprise the basic sections such as executive summary, market analysis, product or service details, financial plan, etc. The only difference is the amount of space each section obtains and the narrative it is constructed to convey.

- An investor plan expands on market research, financial projections, and growth potential because it needs to prove scalability and return.

- A loan or SBA plan uses the same structure but focuses on stability. It highlights cash flow, collateral, and repayment schedules instead of market opportunity.

- A lean plan condenses all of this into one or two pages. It focuses on key assumptions, early metrics, and milestones; quick to write, easy to update.

- An operational or strategic plan is written for your team. It focuses less on finance and more on systems, accountability, and execution.

So the outline stays consistent, but the purpose shapes the depth. Once you know who you’re writing for and what you need to prove, the structure takes care of itself.

So the outline stays consistent, but the purpose shapes the depth. Once you know who you’re writing for and what you need to prove, the structure takes care of itself.

How does your business plan change or evolve?

No business plan stays relevant forever. In fact, it’s not meant to. Maybe today you need a plan for applying for a loan. Six months later, you might be pitching to investors. My point is that your goals can change, the numbers can shift, and your expectations from the plan evolve with that. That’s quite normal.

It is called adaptive planning. That means treating your business plan like a living system, not a static document. The smartest founders I know do it regularly. Here’s how they do it:

- Reviewing assumptions every quarter: Investigate what has changed (customers, costs, or market behavior) and re-calculate your forecasts.

- Changing the focus as the goal shifts: Customize the story and metrics of your business to the audience.

- Supporting each update with up-to-date data: Support all changes with customer reviews, financial reports, and market indicators.

When your business continues to evolve, and your strategy remains the same, then it is already old-fashioned. The wisest founders take their plan as pilots do their instruments: They check it and make some changes, and hope that their plan will help them to make the next decision.

Conclusion

By now, you probably see that no single business plan fits every situation. The type that works when you’re just testing an idea won’t hold up when you’re raising money or scaling a team. Each stage demands a different level of depth, focus, and proof, and knowing which plan to use is half the strategy.

The point isn’t to write the “perfect” plan; it’s to write the one that fits your goal right now. As your business evolves, so should your plan. That’s how you stay clear, adaptable, and ready for the next move.

And that is where Upmetrics will come in. Depending on where you are or where you want to go, it provides you with the framework, the resources, and the directions that design a plan that works. You may use a template and make it audience-friendly, or have the AI assistant guide you through the initial one- make something that seems complicated look simple and achievable.

The reason is that a good business plan is not just what is written in it, but how it can help you be in motion at the end of the day..