Executive Summary

PawHaven Kennel & Boarding is a startup, all-day dog boarding business operating from a purpose-built facility located in Fort Mill, South Carolina. The business is designed as a single-location operation with a fixed capacity of 30 boarding units and does not offer daycare, training, grooming, or veterinary services. This narrow service scope is intentional and allows PawHaven to maintain predictable staffing, consistent sanitation routines, and controlled daily operations.

The facility consists of 20 Classic Runs and 10 Luxury Suites. Both unit types follow the same feeding, cleaning, and care standards, with differentiation limited to privacy and amenities rather than service quality. Each dog is assigned a single unit for the full duration of its stay. Units are not rotated, and the business does not overbook. This operating model reduces animal stress, simplifies cleaning schedules, and allows staff to follow consistent care routines regardless of occupancy levels.

PawHaven operates with fixed capacity and conservative staffing assumptions. Staffing levels are set to safely support daily care requirements, with limited variable labor added only during peak demand periods. The owner, Michael Reynolds, manages daily operations directly and does not take a salary during the first three to four years. This reduces fixed payroll costs and allows close oversight of intake procedures, care standards, and facility operations during the ramp-up period.

Revenue is generated through all-day boarding and a limited set of optional add-on services designed to increase per-stay revenue without adding complexity. These include:

- Additional supervised playtime sessions

- Special feeding routines based on the owner’s instructions

Grooming services are not performed on-site and are coordinated externally only when requested to avoid disruption to daily operations.

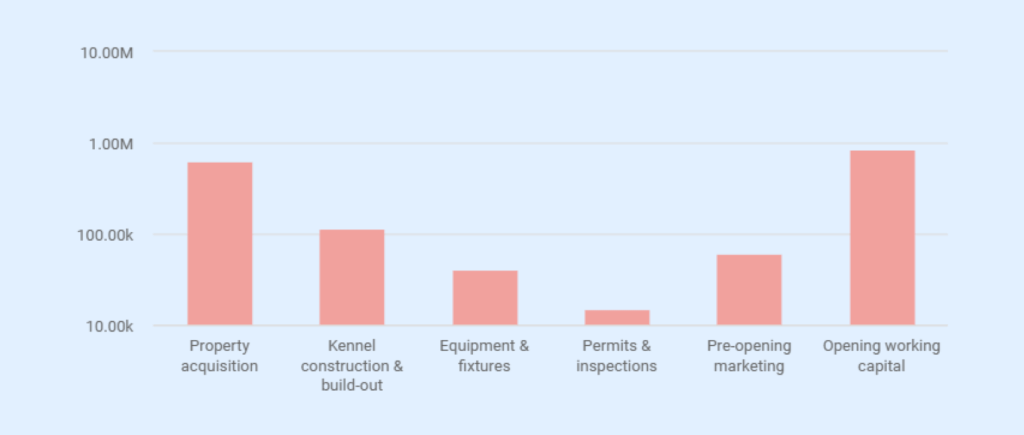

Total startup costs are $850,000, funded through $350,000 in owner equity and a $500,000 commercial term loan. Funds are allocated to property acquisition, kennel construction and build-out, equipment, permitting, and opening working capital. The facility is owner-occupied, and loan payments are reflected as debt service rather than operating expenses.

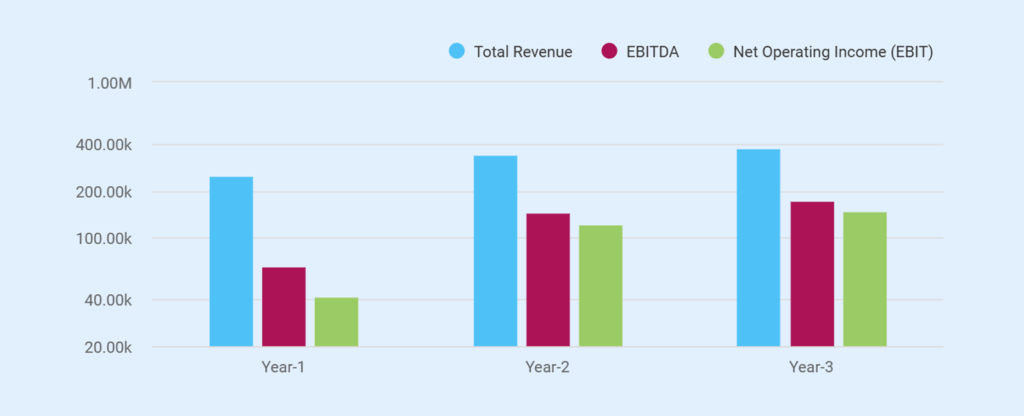

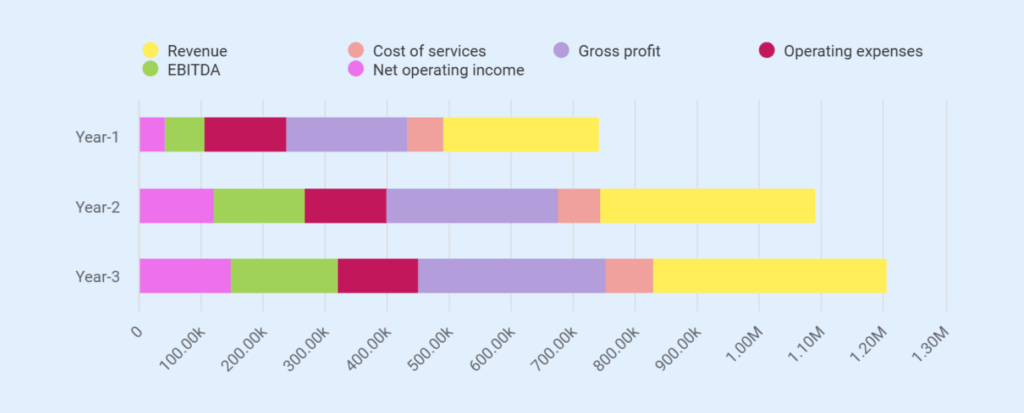

Financial projections show a slow ramp-up in Year 1, followed by stable operations in Years 2 and 3. At stabilization, the business generates approximately $378,000 in annual revenue and $148,300 in net operating income.

Annual debt service is about $55,700, resulting in a Year 3 debt service coverage ratio of 2.6x. The business reaches break-even at roughly seven occupied units per day, or about 23% occupancy, which provides a wide safety margin compared to stabilized utilization targets of 55 to 65%.

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Total Revenue | $253,000 | $346,000 | $378,000 |

| EBITDA | $65,600 | $146,300 | $172,300 |

| Net Operating Income (EBIT) | $41,600 | $122,300 | $148,300 |

| Estimated Debt Service | $55,700 | $55,700 | $55,700 |

| DSCR | n/a | 2.2 x | 2.6x |

PawHaven is structured as a controlled boarding business focused on predictable operations, disciplined cost control, and consistent care standards rather than high-volume or activity-driven services.

A business plan shouldn’t take weeks

Business Overview

PawHaven Kennel & Boarding is a startup commercial dog boarding business operating from a purpose-built facility at 11840 Meadow Ridge Parkway, Fort Mill, South Carolina 29715. The business will be established as a single-location operation designed specifically for all-day dog boarding rather than daycare or veterinary services.

Facility and Boarding Model

The facility contains 30 boarding units, structured to serve both standard-care and premium-care customers within one controlled operating model:

- 20 Classic Runs designed to support consistent, repeat boarding demand and longer stays

- 10 Luxury Suites offering private enclosed spaces with features such as in-suite webcams, generating higher per-night revenue without increasing staffing or fixed costs

This hybrid structure allows PawHaven to balance utilization stability with revenue efficiency while maintaining consistent care routines.

Legal Structure and Ownership

PawHaven Kennel & Boarding is organized as a South Carolina limited liability company (LLC) and is owned by a single member.

The owner will not take a salary during the projection period (first 3–4 years), which will reduce fixed operating costs and support early-stage cash flow coverage.

Facility Size and Space Allocation

The business will operate from a 6,200 square foot purpose-built kennel facility in Fort Mill, South Carolina. This area has a growing residential population, high pet ownership, and easy access to Rock Hill and the greater Charlotte metro area.

The facility is divided into two main areas to support smooth operations and safe animal care:

- Boarding and Animal Care Areas (approximately 5,200 sq ft):

This space includes 30 boarding units made up of 20 Classic Runs and 10 Luxury Suites. It also allows room for staff movement, cleaning, ventilation, and clear separation between standard and premium areas to help control noise and maintain cleanliness. - Support and Operations Areas (approximately 1,000 sq ft):

This area includes the front desk and intake space, food prep and storage, laundry and cleaning areas, staff workspace, supply storage, and utility rooms needed for daily operations.

The facility is designed specifically for animal boarding. It features sealed concrete floors, proper drainage, secure enclosures, and ventilation systems that support cleanliness and odor control. Zoning and permits will meet commercial kennel requirements, reducing regulatory risk compared to converted buildings.

The property also allows for easy drop-off and pickup, with on-site parking that supports customer access without interrupting daily operations.

Regulatory Standing

Commercial dog boarding in South Carolina requires compliance with local zoning, animal welfare, and sanitation regulations. The facility has been designed to meet commercial animal boarding standards, including containment, ventilation, waste handling, and cleaning protocols.

The business maintains appropriate insurance coverage, including general liability, property coverage, and animal care liability. Vaccination requirements and sanitation protocols are enforced as part of standard operating procedures to reduce health and safety risks.

Any required inspections, permits, and certifications are included in startup costs. Operations commence only after all regulatory approvals are secured.

Keys to Success

PawHaven’s performance will depend on a focused operating model and clear execution priorities.

Key Success Factors

- Occupancy stabilization: Achieving and maintaining stable unit occupancy to support predictable cash flow.

- Staffing discipline: Controlling labor costs by maintaining fixed staffing levels and adding variable labor only during peak demand.

- Facility-driven differentiation: Using a purpose-built facility and two-tier unit mix to serve both standard and premium customers without operational complexity.

Business Goals

The following business goals guide operational planning and performance during the early and stabilized stages of the business.

- Reach stabilized occupancy levels within the first 2 years of operation.

- Maintain controlled operating costs while meeting care and sanitation standards.

- Generate consistent operating income sufficient to support ongoing expenses and debt obligations.

- Build a reliable, repeat customer base within the local service area.

Want a professional plan like this sample?

Upmetrics AI generate a complete, investor-ready plan for you.

Market Overview

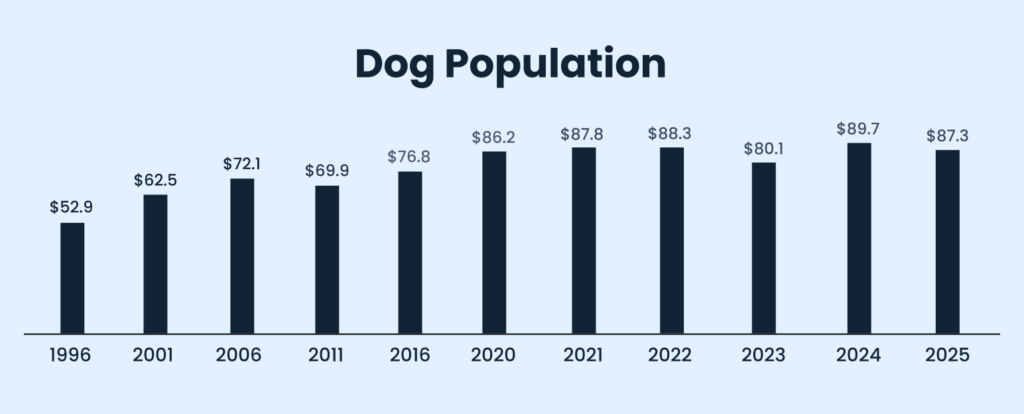

The population of pet dogs in the United States has grown steadily, rising from an estimated 52.9 million dogs in 1996 to approximately 87.3 million dogs in 2025, supporting long-term demand for pet care and boarding services.

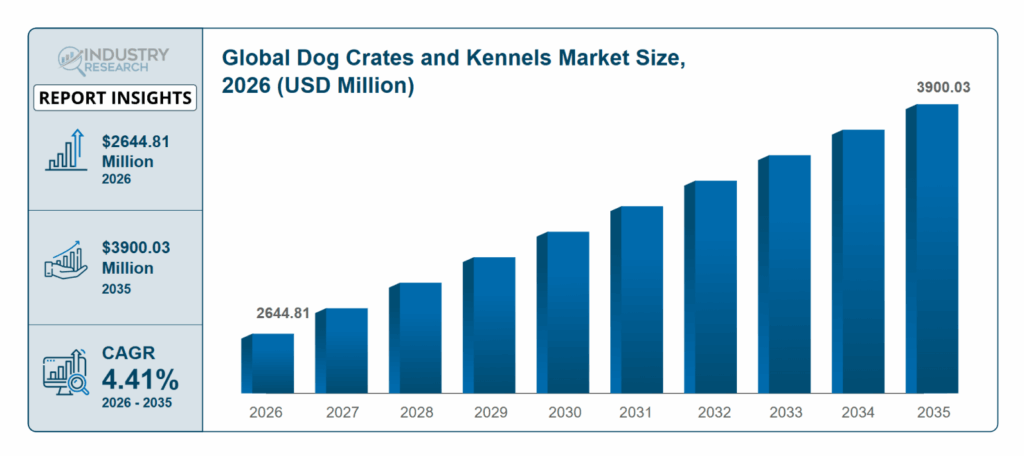

Globally, the dog crates and kennels market size is estimated at $2644.81 million in 2026 and is expected to reach $3900.03 million by 2035. Urban pet owners play a major role in this market.

Local Market Conditions

South Carolina’s pet grooming and boarding industry is growing as more people own pets and spend money on their care. In 2025, the industry is expected to generate about $253.2 million.

There are around 2,850 pet grooming and boarding businesses in the state, with new ones opening each year. This growth is supported by expanding suburbs, more working families, and a stronger need for professional pet care.

Overall, demand for pet boarding in South Carolina remains steady. A growing population and continued spending on pets support the market for a well-run boarding facility.

Target Customer Segments

PawHaven serves four primary customer segments, each with different boarding needs and price sensitivity:

| Segment | Typical Household | Boarding Behavior |

|---|---|---|

| Working Professionals | Dual-income households | Short to mid-length stays tied to work travel |

| Traveling Families | Families with pets | Multi-day stays during vacations and school breaks |

| Long-Stay Clients | Extended travel or relocation | Consistent use of Classic Runs |

| Premium Care Clients | Higher-income households | Prefer Luxury Suites with webcams |

Classic Runs serve as the volume driver, while Luxury Suites serve customers prioritizing privacy and monitoring. Importantly, the business does not rely on premium customers for baseline utilization.

Market Risks

Dog boarding is operationally sensitive, and small missteps are visible quickly. The primary market risks include:

- Demand variability: Boarding demand fluctuates seasonally. This is mitigated by low break-even occupancy and a unit mix that supports baseline utilization even during off-peak periods.

- Price sensitivity: During economic softening, customers may trade down from premium suites to standard runs rather than stop boarding entirely. The presence of Classic Runs protects volume.

- Capacity competition: New facilities could enter the market as the area grows. Early customer retention, consistent service quality, and repeat usage reduce exposure to future competition.

Competitive Landscape

TheFort Mill and Rock Hill area includes a mix of direct and indirect pet boarding competitors with varying service levels.

| Competitor Type | Primary Strength | Primary Limitation |

|---|---|---|

| Direct – Corporate boarding facilities (e.g., PetSuites Rock Hill) | Premium facilities, brand recognition | Higher pricing, less local control |

| Direct – Daycare-heavy boarding facilities (e.g., Camp Bow Wow Fort Mill) | Social play and brand visibility | Less suitable for overnight-only and long-stay boarding |

| Direct – Veterinary boarding kennels | Medical oversight | Limited amenities, rigid schedules |

| Indirect – Home-based sitters | Lower cost | Capacity limits and reliability concerns |

| Indirect – Informal pet sitting services | Flexible arrangements | Lack of facility standards and consistency |

PawHaven does not compete on lowest price or daycare-focused programming. Instead, it is positioned as a purpose-built, overnight-first boarding facility with predictable standards, controlled capacity, and two pricing tiers designed to serve both standard-care and premium customers.

Competitive Positioning

PawHaven’s positioning is defined by facility design and operating discipline, not branding or promotional pricing.

Key positioning elements include:

- Two-tier pricing under one roof, allowing customers to self-select based on needs

- A purpose-built facility designed for sanitation and containment

- Owner-managed oversight rather than absentee management.

Stop Googling competitors for hours

Services Offered

Service Overview

PawHaven Kennel & Boarding provides overnight dog boarding services designed around consistency, sanitation, and predictable care routines rather than high-activity daycare programming. Services are intentionally limited in scope to maintain control over staffing, cleanliness, and animal safety.

The business operates 30 total boarding units, a capacity selected to balance revenue coverage with manageable labor requirements. Unit mix, pricing tiers, and service offerings reflect conservative assumptions drawn from the facility design and operating model, not speculative service expansion.

Boarding Services

PawHaven offers two primary boarding services, each serving a distinct customer need while sharing the same core care standards.

Optional Add-On Services

Add-on services will be offered selectively to increase per-stay revenue while avoiding operational complexity. These services will be scheduled based on staffing availability and treated as incremental revenue rather than core assumptions in the financial projections.

Optional services will include additional supervised playtime sessions, special feeding routines based on owner-provided diets or schedules, and coordination with third-party grooming providers when requested. Grooming services will be arranged externally and aligned with pickup timing to avoid disruption to daily operations.

All add-on services will be priced individually and structured so they do not materially change staffing levels, facility usage, or daily operating routines.

Capacity Management and Service Limits

PawHaven does not exceed the designed capacity or overbook units. Each dog is assigned a specific unit for the duration of its stay, reducing stress on animals and minimizing cleaning overlap.

The business does not offer:

- Open-play daycare programs

- Training services

- Veterinary or medical boarding beyond basic medication administration

This focus limits liability exposure and keeps staffing requirements predictable.

Pricing Strategy

Pricing is structured to support utilization, cash flow stability, and operational control rather than price competition.

| Service Tier | Pricing Approach |

|---|---|

| Classic Runs | Competitive mid-market pricing to support repeat usage |

| Luxury Suites | Premium pricing tied to privacy and monitoring features |

| Add-ons | Priced to cover labor and time without driving scheduling strain |

The blended average nightly rate used for financial projections is $56, reflecting the weighted mix of Classic Runs and Luxury Suites at stabilized occupancy.

The business does not attempt to undercut home sitters or large corporate boarding chains. Customers selecting PawHaven are assumed to value facility quality, predictable care, and availability over lowest-price options.

Service Quality and Care Standards

All boarding services follow consistent care protocols, including:

- Scheduled feeding and cleaning routines

- Controlled exercise periods

- Daily sanitation checks

- Vaccination verification prior to boarding

Care standards are uniform across service tiers. The distinction between Classic Runs and Luxury Suites relates to privacy and amenities, not baseline care quality.

Operations Plan

PawHaven Kennel & Boarding operates as a controlled, overnight-only dog boarding facility with a fixed capacity of 30 boarding units. Daily operations are designed around consistency, sanitation, and predictable care routines rather than high-activity or open-play programming.

Operating Schedule

PawHaven Kennel & Boarding will operate seven days per week to support consistent boarding demand and accommodate customer travel schedules. Drop-off and pickup will be handled through scheduled time windows to manage traffic flow, maintain sanitation standards, and ensure smooth staff coordination.

Overnight boarding will include overnight monitoring with limited staff presence, supported by secure facility design and defined care protocols. This approach balances animal safety and supervision with controlled labor costs.

Daily Operations

Daily operations at PawHaven are structured to ensure consistent care, controlled capacity, and a clean, well-managed boarding environment for every dog.

- Each dog is assigned a specific boarding unit for the full duration of its stay.

- Unit assignments are fixed to prevent overbooking and reduce animal stress.

- Feeding routines follow owner-provided instructions and set facility schedules.

- Cleaning and sanitation are performed daily according to facility protocols.

- Exercise and movement are conducted on structured schedules rather than open play.

- Dogs are monitored regularly for comfort, behavior, and basic health indicators.

- Check-out times are coordinated to manage traffic flow and maintain sanitation standards.

Intake Documentation and Check-In Controls

Each boarding stay is governed by a standardized intake packet completed prior to admission. Intake documentation includes owner contact details, vaccination verification, feeding instructions, medication disclosures, emergency authorization, and acknowledgment of boarding policies. These forms are reviewed during check-in and retained on file to support consistent care delivery and risk control.

This structure supports consistent care delivery and predictable daily operations across all boarding stays.

Compliance and Insurance

PawHaven Kennel & Boarding will operate in compliance with all applicable local zoning, animal welfare, and sanitation regulations governing commercial dog boarding facilities in South Carolina. All required permits, inspections, and operating approvals will be secured prior to opening.

The business will maintain appropriate insurance coverage, including general liability, property coverage, and animal care liability insurance. Vaccination verification and sanitation protocols will be enforced as part of standard operating procedures to reduce health, safety, and compliance risks.

As part of the intake process, PawHaven requires owners to authorize a limited medical power of attorney. This authorization permits the business to seek veterinary care in the event of an emergency when the owner cannot be reached. All medical decisions are limited to emergency stabilization and are coordinated with licensed veterinary providers. This policy reduces health risk exposure and ensures timely care without expanding the business into veterinary services.

Ownership and Day-to-Day Control

PawHaven Kennel & Boarding is owned and run by Michael Reynolds. He is responsible for daily operations, including scheduling, intake checks, care standards, purchasing supplies, and facility upkeep. Keeping management in one place allows for faster decisions and consistent care, especially during the early stages of the business.

The owner will not take a salary during the first three to four years. This keeps payroll costs lower while the business builds steady occupancy.

Staffing Structure

| Role | Monthly Cost | Key Responsibilities |

|---|---|---|

| Kennel Manager (1) | $3,500 | Oversees daily operations, staff scheduling, intake coordination, and care standards |

| Kennel Technicians (2) | $5,200 | Animal care, feeding, cleaning, monitoring, and basic customer interactions |

| Part-Time / Peak Support (1) | Variable | Added during busy periods for cleaning, animal handling, and intake support |

| Fixed Monthly Payroll | $8,700 |

- Annual Fixed Payroll: $104,400

Staffing Assumptions

The kennel operates with a small full-time team for daily care and facility maintenance. Part-time staff are added only during high-occupancy periods and treated as variable costs. The owner supports operations during peak periods to control payroll and maintain service quality.

Does your business plan feel generic or unclear?

Customize your plan to adapt to investor/lender interests

Marketing Plan

Marketing Strategy Overview

PawHaven Kennel & Boarding uses a four-channel local marketing system designed to attract both first-time boarding clients and repeat customers within its Fort Mill and Rock Hill service area. The goal is to maintain strong occupancy during peak travel seasons while building steady, year-round demand from working professionals, traveling families, and long-stay boarding clients.

The marketing mix focuses on low-cost, high-intent channels rather than broad paid advertising. This keeps early operating expenses controlled and aligns marketing activity with the business’s capacity-driven model rather than volume-driven promotions.

Social Media (45% Allocation)

Social media is the business’s most visible trust-building channel. It highlights the facility environment, unit layouts, sanitation standards, and premium suite features such as webcams. Visual transparency is critical in pet boarding decisions, as customers want reassurance about cleanliness, space, and care conditions before booking.

This channel supports:

- Families researching boarding options before vacations

- Working professionals are comparing local providers

- Premium-suite customers seeking reassurance and monitoring features

- Existing customers validating repeat bookings

Content remains consistent year-round but increases ahead of peak travel periods such as summer and major holidays. Posts also reinforce service tiers and booking reminders rather than discounts, helping protect margins while driving advance reservations.

SEO and Google Visibility (25% Allocation)

Search visibility is critical in a local service market where customers frequently search shortly before travel. SEO focuses on practical, intent-driven queries such as “dog boarding Fort Mill,” “dog kennel near Rock Hill,” and “overnight dog boarding.”

This channel supports:

- Customers booking with a limited lead time

- New residents searching for a long-term boarding provider

- Comparison shoppers evaluating availability and location

- Referral validation after word-of-mouth recommendations

Strong Google Maps visibility directly supports daily booking flow, particularly from first-time customers unfamiliar with local boarding options.

Veterinary and Groomer Partnerships (20% Allocation)

Relationships with veterinarians and groomers form the most predictable referral channel outside of digital search. These partners frequently recommend boarding options when clients travel or require extended care.

Operational coordination is essential. The owner maintains direct communication with partner clinics and grooming providers to confirm availability, service scope, and intake requirements. This ensures referrals are appropriate and expectations are aligned.

This channel supports weekday and off-season occupancy, helping the business reach stabilized utilization levels assumed in Year 2 and Year 3 projections.

Email Marketing (10% Allocation)

Email serves PawHaven’s repeat-customer base. It is used for:

- Holiday and peak-season booking reminders

- Advance reservation prompts

- Service updates and care reminders

- Encouraging repeat usage throughout the year

Because email is low-cost and retention-focused, it strengthens customer lifetime value without increasing acquisition costs. Most email communication is tied to travel seasons rather than promotional discounts.

Seasonal Marketing Structure

Marketing intensity increases during the highest boarding demand periods: summer travel months, major holidays, and school breaks. Campaigns during these windows focus on availability reminders, advance booking deadlines, and premium suite visibility.

In slower periods, such as early-year months, the focus shifts to review generation, partner outreach, and repeat-customer reactivation. This ensures marketing resources remain aligned with expected occupancy patterns and staffing capacity.

How Marketing Supports Revenue Growth

Marketing channels tie directly to occupancy stabilization assumptions rather than price increases. Social media and SEO support booking volume, partner referrals improve booking quality, and email increases repeat usage.

Together, these channels create the consistent booking flow needed to support the revenue progression assumed in the financial plan, moving from ramp-up conditions in Year 1 to stabilized performance in Years 2 and 3 without exceeding facility capacity.

Don’t spend weeks on your first draft

Complete your business plan in less than an hour

Financial Plan

Key Financial Assumptions

- The business operates 30 boarding units, including standard runs and luxury suites.

- Financial projections use an average nightly rate of $56.

- Year 1 represents ramp-up, while Year 2 and Year 3 reflect stabilized operations.

- The owner does not take a salary during the projection period (first 3–4 years).

- Payroll includes only listed staff, and variable costs scale with occupancy.

- Loan funds are used only for facility acquisition and build-out.

- Depreciation is calculated on a straight-line, non-cash basis.

- The facility is owner-occupied; mortgage payments are reflected in debt service and not treated as operating expenses.

- Projections are presented on a pre-tax basis.

The financial projections assume a $500,000 commercial term loan amortized over 20 years at a fixed interest rate, resulting in annual debt service of approximately $55,700. Principal and interest payments begin immediately following funding and are reflected consistently across the income statement, cash flow statement, and balance sheet.

Startup Costs

| Startup Item | Amount ($) |

|---|---|

| Property acquisition | 620,000 |

| Kennel construction & build-out | 115,000 |

| Equipment & fixtures | 40,000 |

| Permits & inspections | 15,000 |

| Opening working capital | 60,000 |

| Total Startup Costs | 850,000 |

Projected Income Statement (3 Years)

| Line Item | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Revenue | |||

| Boarding revenue | 243,600 | 334,000 | 364,000 |

| Add-ons and extras | 9,400 | 12,000 | 14,000 |

| Total revenue | 253,000 | 346,000 | 378,000 |

| Cost of services (variable) | |||

| Supplies and sanitation | 18,000 | 22,000 | 24,000 |

| Utilities and waste | 24,000 | 28,000 | 30,000 |

| Repairs and maintenance | 12,000 | 15,000 | 16,500 |

| Peak labor support | 3,000 | 4,300 | 4,800 |

| Total cost of services | 57,000 | 69,300 | 75,300 |

| Gross profit | 196,000 | 276,700 | 302,700 |

| Gross margin | 77.5% | 80.0% | 80.0% |

| Operating expenses (fixed) | |||

| Fixed payroll | 104,400 | 104,400 | 104,400 |

| Insurance | 9,500 | 9,500 | 9,500 |

| Marketing | 10,000 | 10,000 | 10,000 |

| Software and admin | 6,500 | 6,500 | 6,500 |

| Total operating expenses | 130,400 | 130,400 | 130,400 |

| EBITDA | 65,600 | 146,300 | 172,300 |

| Depreciation | 24,000 | 24,000 | 24,000 |

| Net operating income (NOI / EBIT) | 41,600 | 122,300 | 148,300 |

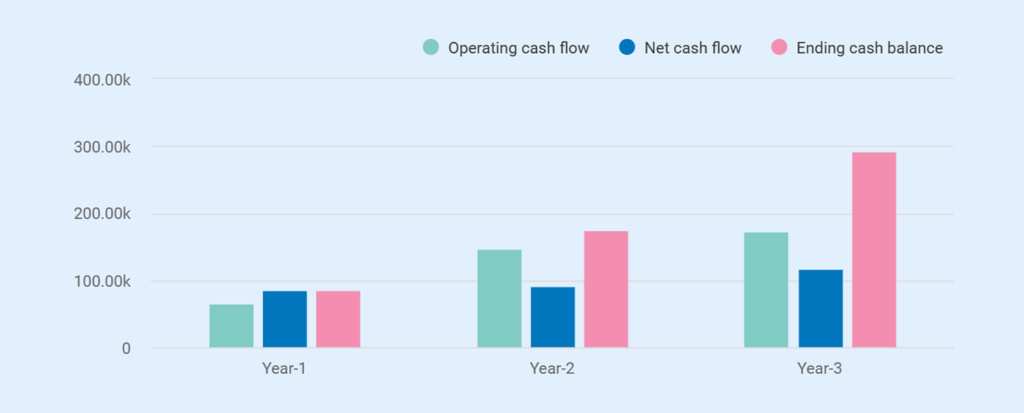

Cash Flow Statement (3 Years)

| Cash Flow Item | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Operating cash flow | |||

| NOI | 41,600 | 122,300 | 148,300 |

| Add back depreciation | 24,000 | 24,000 | 24,000 |

| Operating cash flow | 65,600 | 146,300 | 172,300 |

| Investing activities | |||

| Capital expenditures (facility, build-out, permits, equipment) | (790,000) | – | – |

| Financing activities | |||

| Loan proceeds | 500,000 | – | – |

| Owner equity | 350,000 | – | – |

| Debt service | (55,700) | (55,700) | (55,700) |

| Net cash flow | 84,900 | 90,600 | 116,600 |

| Beginning cash | 0 | 84,900 | 175,500 |

| Ending cash | 84,900 | 175,500 | 292,100 |

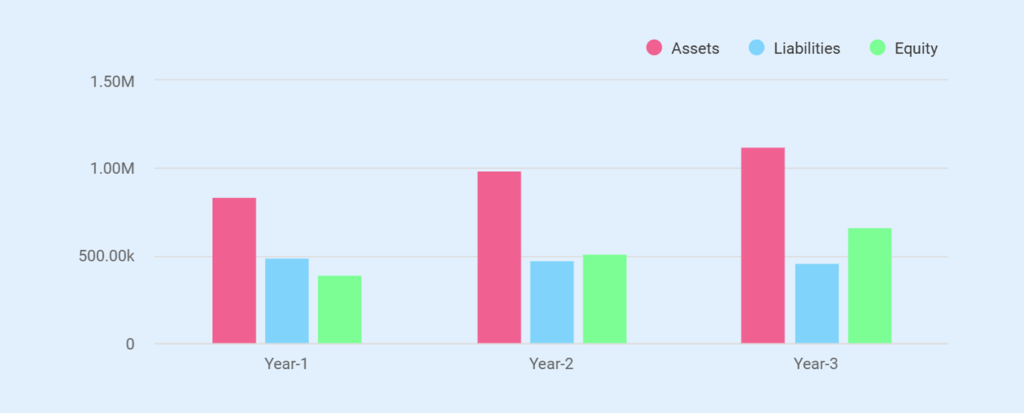

Balance Sheet (3 Years)

| Line Item | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| ASSETS | |||

| Cash | 84,900 | 175,500 | 292,100 |

| Building | 620,000 | 620,000 | 620,000 |

| Kennel build-out | 115,000 | 115,000 | 115,000 |

| Equipment & fixtures | 40,000 | 40,000 | 40,000 |

| Accumulated depreciation | (24,000) | (48,000) | (72,000) |

| Total Assets | 835,900 | 987,900 | 1,121,600 |

| LIABILITIES | |||

| Bank term loan | 487,500 | 474,000 | 459,400 |

| Total Liabilities | 487,500 | 474,000 | 459,400 |

| EQUITY | |||

| Owner equity (paid-in) | 350,000 | 350,000 | 350,000 |

| Retained earnings (cumulative NOI) | 41,600 | 163,900 | 312,200 |

| Total Equity | 391,600 | 513,900 | 662,200 |

| Total Liabilities + Equity | 835,900 | 987,900 | 1,121,600 |

Spreadsheets are exhausting & time-consuming

Build accurate financial projections w/ AI-assisted features

Use of Funds

| Use | Amount ($) |

|---|---|

| Building acquisition | 620,000 |

| Kennel build-out | 115,000 |

| Equipment & fixtures | 40,000 |

| Permits & licenses | 15,000 |

| Working capital | 60,000 |

| Total | 850,000 |

Break-Even Analysis

- Fixed costs: $130,400/year

- Daily fixed cost: $357

- Blended nightly rate: $56

- Units needed per day: 7

- Break-even occupancy: 23%

Operating break-even occurs at approximately 7 occupied units per day, providing a wide safety margin relative to stabilized utilization targets of 55–65%.

Stabilized Lender Metrics (Year 3)

| Metric | Value |

|---|---|

| NOI (Year 3) | $148,300 |

| Annual debt service | $55,700 |

| DSCR | 2.6 x |

| EBITDA margin | 46% |

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.