Executive Summary

CareBridge Home Health Services is a Medicare-intent home health agency based in Raleigh, North Carolina. The company provides physician-ordered, skilled clinical care in patients’ homes across Wake and Durham Counties.

CareBridge is structured as an LLC and is owned and clinically led by Daniel Harper, RN (Registered Nurse), BSN (Bachelor of Science in Nursing), who serves as owner and director of clinical services.

CareBridge is a clinical home health model, not non-medical home care. The agency does not provide companionship, sitter services, homemaker support, or hourly caregiving.

Problem

The healthcare system of Raleigh-Durham is experiencing long-term pressure to reduce the duration of hospitalization and restrict the usage of post-acute facilities. According to one report, the number of people who will seek in-home healthcare will grow by 22% by 2034. Furthermore, the 3 intersecting reasons as to why dependable home health services are required:

1) Caregiver shortage: Nurses and therapists in the region are increasingly experiencing shortages in qualified personnel, and it is more difficult to staff units in the hospital and facility-based care.

2) Increasing hospital readmission expenses: Medicare punishes hospitals due to avoidable readmission, which presents the urgency of quality after-acute care.

3) Aging population: The population of Medicare-eligible beneficiaries in Wake and Durham Counties is increasing, which is pushing up the demand for skilled in-home clinical care.

Solution

CareBridge provides 4 core Medicare-covered skilled disciplines delivered in the home:

- Skilled Nursing (RN, LPN)

- Physical Therapy (PT)

- Occupational Therapy (OT)

- Speech-Language Pathology (SLP)

Clinical services include medication management, wound care, postoperative care, and patient and caregiver education. CareBridge employs HIPAA (Health Insurance Portability and Accountability Act) compliant EMR (Electronic Medical Record) and OASIS (Outcome and Assessment Information Set) ready systems with point-of-care documentation in support of quality and timely records and good compliance.

Mission

CareBridge’s mission is to deliver reliable, physician-ordered skilled care in the home while meeting Medicare standards and supporting safe recovery, ongoing care, and patient independence. The agency focuses on clinical accountability, clear documentation, and consistent coordination with physicians and discharge teams to ensure care continues smoothly beyond the hospital setting.

Target Market

CareBridge serves Medicare-eligible, homebound patients in Wake and Durham Counties, including:

- Post-acute hospital discharges needing skilled follow-up

- Chronic disease patients need monitoring and teaching

- Therapy-driven patients focused on mobility and daily function recovery

The business is referral-driven. Primary referral sources are hospital discharge planners, physician offices, and case management networks.

Funding Request

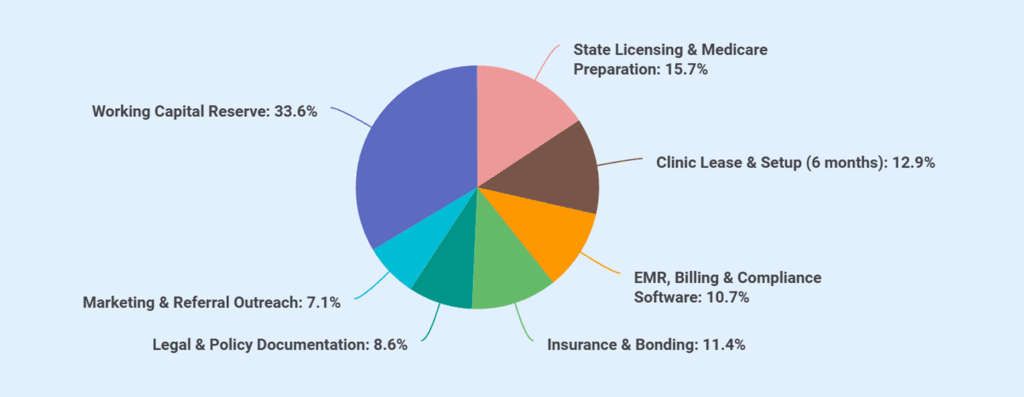

CareBridge is seeking $100,000 through First Citizens Bank Healthcare and Professional Services Lending at a 6% rate of interest for 10 years. The funding will be supported by a $40,000 owner equity injection, for a total startup capital of $140,000.

Startup funds will be used for:

| Category | Amount (USD) |

|---|---|

| State Licensing & Medicare Preparation | $22,000 |

| Clinic Lease & Setup (6 months) | $18,000 |

| EMR, Billing & Compliance Software | $15,000 |

| Insurance & Bonding | $16,000 |

| Legal & Policy Documentation | $12,000 |

| Marketing & Referral Outreach | $10,000 |

| Working Capital Reserve | $47,000 |

| Total Startup Capital Required | $140,000 |

Financial Snapshot

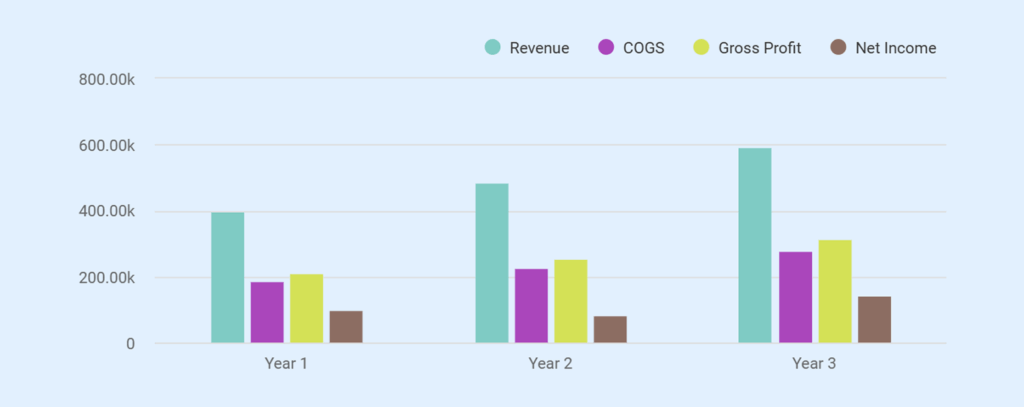

The financial model is built around Medicare episode reimbursement with a cost structure designed to support controlled growth. Revenue increases as referral relationships mature and patient volume expands at a measured pace rather than through rapid scale.

Projected revenue reflects this progression:

- Year 1 total revenue: $400,000

- Year 2 total revenue: $484,000

- Year 3 total revenue: $594,800

This revenue path reflects steady referral intake, consistent service delivery, and disciplined capacity expansion, supporting predictable cash flow and long-term financial stability.

Want a professional plan like this sample?

Upmetrics AI generate a complete, investor-ready plan for you.

Company Overview

CareBridge Home Health Services is structured to operate as a Medicare-focused home health agency with clear ownership, defined leadership, and an operating model built for compliance and reliability. The company’s business structure, ownership, and business model are as follows:

Business Structure and Location

CareBridge Home Health Services operates as a North Carolina–registered limited liability company. The business maintains its administrative and clinical base at 7421 Medical Park Drive, Suite 220, Raleigh, North Carolina 27607.

Our location places the agency within proximity to major hospitals, physician groups, and discharge planning teams across Wake and Durham Counties.

Ownership and Management

Daniel Harper, RN, is the owner of CareBridge Home Health Services. Moreover, he oversees and leads the agency’s clinical and operational direction.

Being the director of clinical services, he owns full decision-making authority. This owner-led structure allows CareBridge to maintain direct clinical oversight, enforce documentation standards, and respond quickly to referral sources without administrative delays.

Business Model

CareBridge operates as a Medicare-intent home health agency focused exclusively on physician-ordered skilled services delivered in the home. The agency builds its model around episode-based Medicare reimbursement and referral-driven patient acquisition. CareBridge does not provide non-medical home care services and does not rely on consumer advertising. Hospitals, physicians, and case managers serve as the primary referral channels.

Working Strategy

CareBridge operates with a controlled-growth strategy built around compliance, referral trust, and disciplined execution. The agency doesn’t chase rapid census expansion.

It grows only when staffing, documentation, and cash flow remain stable. This approach shapes how CareBridge makes day-to-day and growth decisions:

- Accept referrals selectively based on clinical fit, staffing availability, and documentation requirements rather than volume target.

- Prioritize clean start-of-care assessments, complete OASIS documentation, and timely physician orders to reduce denials and payment delays.

- Maintain a lean fixed-cost structure while scaling clinical capacity through per-visit contracted nurses and therapists.

- Build repeat referral relationships by responding quickly to discharge planners and case managers and providing clear communication throughout the episode of care.

- Track episode profitability and visit utilization to avoid over-servicing and protect margins.

- Add administrative or clinical support only after sustained increases in referral volume justify the cost.

- Focus on long-term credibility with hospitals and physicians instead of short-term growth driven by marketing spend.

Such an approach allows CareBridge to stabilize operations in the early years, reach break-even through consistent referral flow, and expand at a pace that preserves clinical quality, compliance, and financial control.

A business plan shouldn’t take weeks

Market Analysis

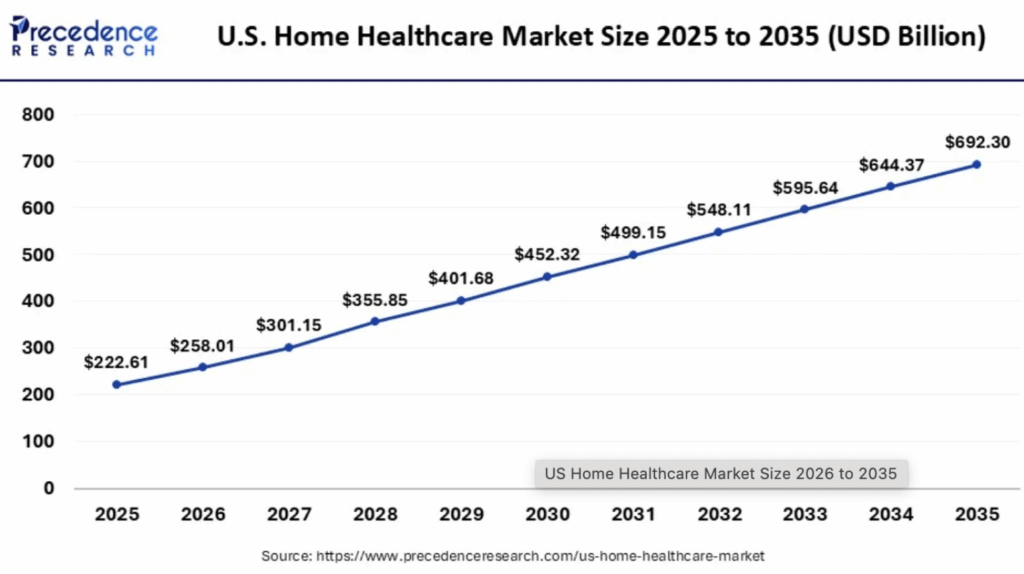

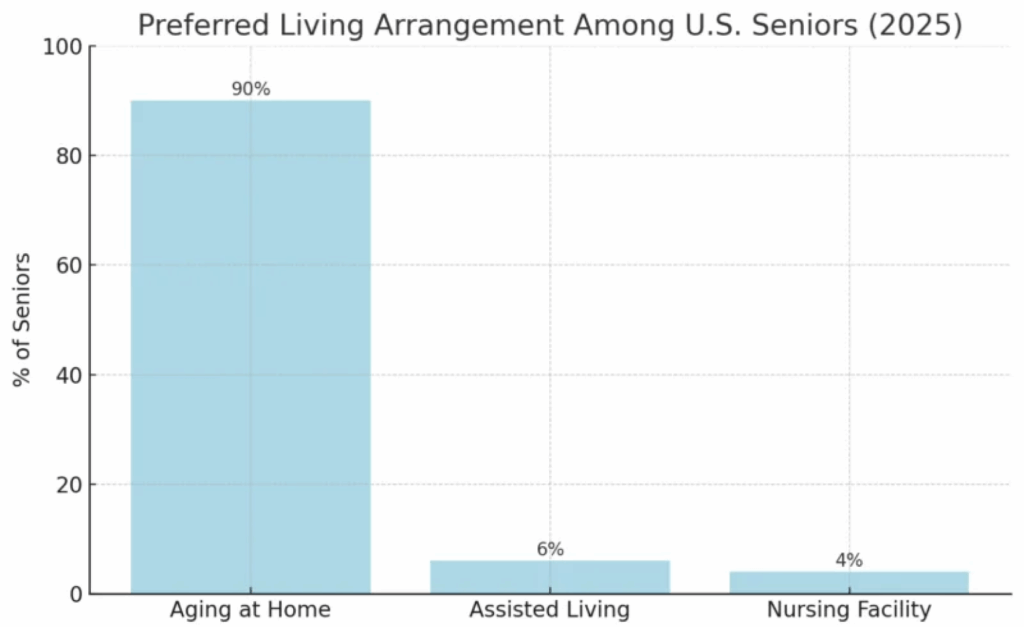

The U.S. home healthcare market is estimated at $222.61 billion in 2025 and is expected to grow to $258.01 billion by 2026.

Notably, a key factor supporting the strength of the home health care model is that nearly 90% of seniors prefer to receive care in their own homes rather than in institutional settings.

These conditions create a clear opportunity for CareBridge to capture steady, referral-driven growth in the home health care business.

With its focus on physician-ordered skilled nursing and therapy services, CareBridge supports hospitals and physicians seeking reliable post-discharge care and reduces gaps in follow-up treatment.

Local Market

Interestingly, in North Carolina, Medicare beneficiaries who use home health services show a far higher level of medical need than the general Medicare population.

Nearly 87.73% of Medicare home health users have three or more chronic conditions, compared to only about 6.95% across all Medicare beneficiaries statewide. highlighting how essential skilled in-home care has become for complex patients. This level of clinical need supports sustained demand for physician-ordered nursing and therapy services rather than short-term or non-medical care.

The home health sector already plays a meaningful role in the state’s economy, supporting over 40,000 employees, creating 58,000+ jobs, and generating $1.6 billion in wages with a total labor income impact of $2.5 billion statewide.

These figures indicate an established referral ecosystem and workforce presence that CareBridge can operate within from day one. For a clinically focused agency, this environment supports steady referral flow, long-term patient needs, and predictable demand for skilled services delivered in the home.

Target Patients

CareBridge focuses on Medicare-eligible, homebound patients who require physician-ordered skilled care. The agency accepts patients only when services meet medical necessity and coverage requirements.

Primary patient groups include:

- Post-acute hospital discharge patients who need skilled nursing or therapy services

- Patients managing chronic conditions such as heart disease, diabetes, or respiratory conditions that require monitoring

- Therapy-driven rehabilitation patients requiring physical, occupational, or speech therapy

- Patients with complex medication regimens who need skilled nursing

- Wound care patients with surgical, pressure, or chronic wounds that require skilled treatment under physician orders.

All patients must be homebound as defined by Medicare and must receive services under active physician orders.

Competitive Analysis

The Raleigh–Durham home health market includes a mix of national providers and health system–affiliated agencies. These organizations set the operating benchmark for referral response, compliance, and scale. CareBridge enters this market with a clear understanding of how these providers operate and where smaller, clinically led agencies can compete effectively.

| Provider | Market Presence | Operating Model | Core Strengths |

|---|---|---|---|

| Amedisys Home Health – Raleigh | Large national provider with broad coverage | Corporate-managed, high patient volume, standardized systems | Strong brand recognition, wide referral network, and established Medicare infrastructure |

| CenterWell Home Health – Durham | National provider affiliated with Humana | Payer-aligned model, centralized operations, scale-driven | Integrated payer relationships, financial stability, and broad clinical staffing |

| Duke Health Home Care Services | Health system–owned provider | Hospital-integrated, referral-first model | Direct access to Duke hospital discharges, strong physician alignment, and clinical credibility |

What This Means for the Market

- These providers dominate volume through scale, system integration, and brand presence.

- Referral sources often rely on them for capacity, but large size can slow intake, care coordination, and communication.

- Clinical oversight and documentation quality vary by branch workload and staffing pressure.

Differentiation and Gaps

CareBridge does not attempt to outscale large national or health system–owned providers. Instead, it operates where scale-based models consistently leave gaps. These gaps create practical entry points for a clinically led, referral-responsive agency.

| Market Gap | How Large Providers Typically Operate | CareBridge’s Approach |

|---|---|---|

| Referral Response Time | Intake queues and centralized call centers often delay acceptance and start-of-care | Direct owner-led intake allows same-day referral review and faster scheduling |

| Clinical Oversight | Clinical leadership spread across a large census and multiple branches | RN owner reviews care plans, documentation, and clinical decisions directly |

| Documentation Quality | High-volume pressure increases the risk of incomplete OASIS and denials | Compliance-first documentation with early chart review and correction |

| Care Coordination | Communication routed through layers of staff | Direct communication with physicians, discharge planners, and case managers |

| Patient Fit Selection | Volume-driven acceptance models | Selective acceptance based on staffing, acuity, and reimbursement alignment |

| Operational Flexibility | Fixed staffing models limit adaptability | Per-visit contracted clinicians scale capacity without fixed overhead risk |

CareBridge competes on execution, not scale. By operating below saturation, maintaining tight clinical control, and building durable referral relationships, the agency sustains growth even in a market dominated by larger players.

Stop searching the internet for industry & market data

Get AI to bring curated insights to your workspace

Services Offered

CareBridge focuses only on services that meet Medicare coverage rules, generate predictable reimbursement, and support long-term referral relationships.

Additional Clinical Services

These services support outcomes and documentation strength rather than serving as standalone revenue lines:

- Medication reconciliation and teaching

- Post-surgical monitoring and recovery support

- Wound assessment and treatment

- Patient and caregiver education

- Care coordination and physician communication

- OASIS assessments and progress reporting

Each service ties directly to medical necessity and documentation requirements that protect reimbursement.

Pricing and Reimbursement Structure

CareBridge operates under Medicare’s episode-based reimbursement model.

| Pricing Element | Description |

|---|---|

| Average Medicare Reimbursement | Approximately $2,000 per episode |

| Billing Method | Medicare home health episode billing |

| Patient Billing | No direct charges for Medicare-covered services |

| Payment Timing | 30 to 60 days after service completion |

| Variability Factors | Patient acuity, visit mix, therapy utilization, compliance |

Cost Control and Margin Protection

CareBridge protects margins through deliberate service delivery choices:

- Uses per-visit contracted clinicians to match staffing with volume

- Avoids fixed payroll expansion until referral volume stabilizes

- Reviews visit utilization to prevent over-servicing

- Aligns care plans tightly with physician orders and coverage rules

These controls reduce exposure to denials, clawbacks, and cash flow strain.

Investors hate amateur writing errors

Instantly improve your plan w/ our AI writing assistant

Marketing Strategy

CareBridge uses a focused, referral-based marketing approach built for Medicare home health operations. The strategy avoids consumer advertising and instead concentrates resources on professional referral relationships that drive consistent, qualified patient volume.

Marketing Budget Overview

CareBridge allocates approximately $800 per month to marketing and referral outreach. This budget supports relationship-building activities rather than high-volume advertising.

| Monthly Marketing Spend | Amount |

|---|---|

| Referral outreach materials | $300 |

| Provider meetings and travel | $250 |

| Educational materials | $150 |

| Networking and professional events | $100 |

| Total Monthly Marketing Budget | $800 |

Core Marketing Channels

CareBridge focuses on three primary referral sources that align with Medicare-covered services:

- Hospital discharge planners: Outreach targets care coordinators and discharge teams responsible for placing patients into post-acute care.

- Physician offices: The agency builds direct relationships with primary care physicians and specialists who order home health services.

- Case management networks: CareBridge engages case managers who coordinate ongoing care for Medicare beneficiaries across settings.

Referral-Driven Growth Strategy

CareBridge grows through referrals, not advertising. The focus is on building trust and strong working relationships. The agency works directly with hospital discharge planners and doctors’ offices, often through in-person visits, to explain services and the intake process.

Clear service details, coverage rules, and contact points make it easy for partners to send referrals. CareBridge follows up regularly to share start-of-care timing and patient updates. Simple educational materials help referral partners understand services, documentation requirements, and Medicare rules.

Customer Acquisition

CareBridge gets patients only through professional referrals. The agency does not use ads or paid marketing. Most patients come from hospital discharge planners, doctors’ offices, and case managers who place Medicare home health patients.

CareBridge focuses on being easy to work with. Referrals are answered quickly, eligibility is checked right away, and start-of-care visits are scheduled on time. After receiving a referral, Medicare coverage is verified, intake is completed, and the referring provider is kept updated on care start and patient progress. Clear communication and dependable follow-through help build strong relationships with referral partners.

Operations

The CareBridge system has a well-defined daily workflow that is structured to comply with Medicare standards to support referral expectations and clinical control. Operations are disciplined and well documented, and the activities of the roles are clear and not scale-related throughout.

Service Area and Location

CareBridge operates from its office at 7421 Medical Park Drive, Suite 220, Raleigh, North Carolina 27607. Clinical services are delivered in patients’ homes across Wake and Durham Counties.

Operating Schedule and Coverage

CareBridge structures its operating hours to align with hospital discharge patterns and physician office workflows.

| Function | Schedule |

|---|---|

| Clinical visits | Monday–Friday, 8:00 AM–5:00 PM |

| Administrative operations | Monday–Friday, 9:00 AM–5:00 PM |

| On-call nursing | As required for active patients |

| Referral intake | Same-day review during business hours |

Daily Operational Flow

Each workday follows a defined sequence to reduce delays and errors:

- Morning intake review

Review new referrals, verify eligibility, confirm physician orders, and assess staffing availability. - Visit scheduling and coordination

Assign visits to contract clinicians based on location, discipline, and patient acuity. - Clinical service delivery

Clinicians complete scheduled visits and document care at the point of service using EMR systems. - Documentation review

Clinical records and OASIS data are reviewed for completeness and compliance. - Referral and physician communication

Provide updates to referral sources and physicians as needed. - Billing preparation

Approved documentation flows to billing and compliance support for claim submission.

Systems and Tools

CareBridge supports operations with systems selected for Medicare compliance and workflow clarity:

- HIPAA-compliant EMR with OASIS functionality

- Point-of-care documentation tools

- Secure communication channels for clinicians and referral partners

- Approved medical supply vendors for clinical needs

Licensing & Compliance

CareBridge operates in a highly regulated environment where licensing, documentation, and ongoing compliance determine both reimbursement eligibility and long-term viability. The agency is structured from inception to meet state and federal requirements before accepting patients or submitting claims.

State Licensing

CareBridge obtains and maintains a North Carolina Home Health Agency (HHA) licence before initiating operations. Licensing requirements include:

- Submission of state licensure application

- Approval of administrative and clinical policies

- Verification of qualified leadership and clinical oversight

- Compliance with state inspection and operational standards

Licensure establishes the legal authority to operate as a home health agency within North Carolina.

Medicare Enrollment and Certification

The home health care will operate as a Medicare-intent agency and complete the full Medicare enrollment and certification process before billing Medicare.

This process includes:

- Medicare provider enrollment application

- Survey readiness preparation

- Completion of the Medicare certification survey

- Approval to bill Medicare for covered home health services

The agency does not begin Medicare billing until certification approval is granted.

Clinical Policies and Procedures

CareBridge follows clear policies that meet Medicare rules and guide daily operations. These policies cover patient admission and discharge, care planning, and infection control to keep patients and staff safe.

The agency also has emergency plans and follows federal rules to protect patient rights and privacy. These policies help CareBridge provide steady care, stay ready for inspections, and reduce compliance risks as the agency grows.

Does your plan sound generic?

Refine your plan to adapt to investor/lender interests

Financial Plan

The financial plan demonstrates CareBridge’s ability to operate profitably while maintaining liquidity, controlling risk, and meeting debt obligations.

It shows how revenue growth, expense discipline, and cash flow management work together to support ongoing operations, regulatory requirements, and timely loan repayment without relying on aggressive assumptions.

Startup Costs Table (and Funding Use)

| Category | Cost (USD) |

|---|---|

| State Licensing & Medicare Preparation | $22,000 |

| Clinic Lease & Setup (6 months) | $18,000 |

| EMR, Billing & Compliance Software | $15,000 |

| Insurance & Bonding | $16,000 |

| Legal & Policy Documentation | $12,000 |

| Marketing & Referral Outreach | $10,000 |

| Working Capital Reserve | $47,000 |

| Total Startup Costs | $140,000 |

Sources of Funds:

- Bank Loan (First Citizens Bank): $100,000

- Owner Equity Injection: $40,000

- Total Funding: $140,000

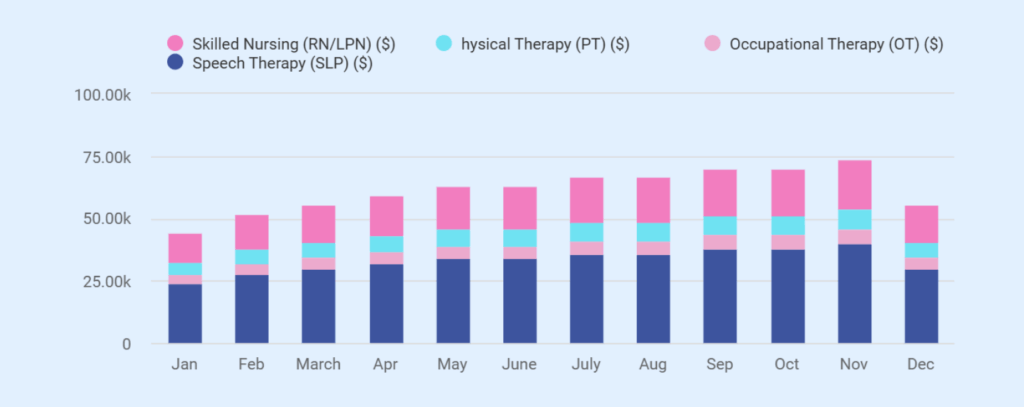

Monthly Revenue (Year 1)

| Month | Skilled Nursing (RN/LPN) | Physical Therapy (PT) | Occupational Therapy (OT) | Speech Therapy (SLP) | Total Monthly Revenue |

|---|---|---|---|---|---|

| January | $12,000 | $4,800 | $3,600 | $3,600 | $24,000 |

| February | $14,000 | $5,600 | $4,200 | $4,200 | $28,000 |

| March | $15,000 | $6,000 | $4,500 | $4,500 | $30,000 |

| April | $16,000 | $6,400 | $4,800 | $4,800 | $32,000 |

| May | $17,000 | $6,800 | $5,100 | $5,100 | $34,000 |

| June | $17,000 | $6,800 | $5,100 | $5,100 | $34,000 |

| July | $18,000 | $7,200 | $5,400 | $5,400 | $36,000 |

| August | $18,000 | $7,200 | $5,400 | $5,400 | $36,000 |

| September | $19,000 | $7,600 | $5,700 | $5,700 | $38,000 |

| October | $19,000 | $7,600 | $5,700 | $5,700 | $38,000 |

| November | $20,000 | $8,000 | $6,000 | $6,000 | $40,000 |

| December | $15,000 | $6,000 | $4,500 | $4,500 | $30,000 |

| Total (Year 1) | $200,000 | $80,000 | $60,000 | $60,000 | $400,000 |

Income Statement (3-Year)

| Item | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue | |||

| Skilled Nursing (RN, LPN) | $200,000 | $242,000 | $296,400 |

| Physical Therapy (PT) | $80,000 | $96,800 | $120,800 |

| Occupational Therapy (OT) | $60,000 | $72,600 | $88,800 |

| Speech-Language Pathology (SLP) | $60,000 | $72,600 | $88,800 |

| Total Revenue | $400,000 | $484,000 | $594,800 |

| Cost of Goods Sold (COGS) | |||

| Contract Nurses (per-visit) | $108,000 | $131,000 | $161,000 |

| PT / OT / SLP Contract Costs | $80,000 | $96,500 | $118,500 |

| Total COGS | $188,000 | $227,500 | $279,500 |

| Gross Profit | $212,000 | $256,500 | $315,300 |

| Gross Margin (%) | 53.0% | 53.0% | 53.0% |

| Operating Expenses | |||

| Clinic Lease & Utilities | $30,000 | $30,000 | $30,000 |

| Insurance | $16,000 | $16,000 | $16,000 |

| Billing & Compliance | $14,400 | $15,000 | $15,600 |

| Marketing & Referral Outreach | $9,600 | $10,000 | $10,500 |

| Software & Administration | $9,000 | $9,500 | $9,500 |

| Part-Time Billing / Compliance Support | $14,400 | $14,400 | $14,400 |

| Owner / Administrator Salary (RN) | $0 | $60,000 | $60,000 |

| Total Operating Expenses | $93,400 | $154,900 | $156,000 |

| EBITDA | $118,600 | $101,600 | $159,300 |

| Depreciation + Amortization | $12,400 | $12,400 | $12,400 |

| EBIT | $106,200 | $97,600 | $155,300 |

| Interest Expense (Loan) | $6,000 | $5,500 | $5,000 |

| Net Income (Pre-Tax) | $100,200 | $83,700 | $141,900 |

Cash Flow Statement (3 Year)

| Cash Flow Item | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Net Income (Pre-tax) | $100,200 | $83,700 | $141,900 |

| Add back: Depreciation + Amortization | $12,400 | $12,400 | $12,400 |

| Change in Working Capital | ($25,000) | ($5,400) | ($7,100) |

| Loan Principal Payments | $0 | ($18,000) | ($18,000) |

| Net Cash Flow | $87,600 | $72,700 | $129,200 |

| Beginning Cash | $47,000 | $134,600 | $207,300 |

| Ending Cash | $134,600 | $207,300 | $336,500 |

Balance Sheet (Year 3)

| Item | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Assets | |||

| Cash | $134,600 | $207,300 | $336,500 |

| Accounts Receivable | $40,000 | $48,400 | $59,500 |

| Prepaid Expenses | $6,000 | $6,000 | $6,000 |

| Deferred Startup Costs (net) | $33,600 | $25,200 | $16,800 |

| Net Fixed Assets | $16,000 | $12,000 | $8,000 |

| Total Assets | $230,200 | $298,900 | $426,800 |

| Liabilities | |||

| Accounts Payable and Accruals | $15,000 | $18,000 | $22,000 |

| Current Portion of Debt | $0 | $18,000 | $18,000 |

| Long-Term Debt | $100,000 | $82,000 | $64,000 |

| Total Liabilities | $115,000 | $118,000 | $104,000 |

| Equity | |||

| Owner Equity | $40,000 | $40,000 | $40,000 |

| Retained Earnings (Cumulative) | $75,200 | $140,900 | $282,800 |

| Total Equity | $115,200 | $180,900 | $322,800 |

| Total Liabilities + Equity | $230,200 | $298,900 | $426,800 |

Spreadsheets are exhausting & time-consuming

Build accurate financial projections w/ AI-assisted features

Break-even analysis

| Break-Even Metrics | Value |

|---|---|

| Monthly Fixed Costs | $7,800 |

| Avg Revenue per Episode | $2,000 |

| Avg Clinical Cost per Episode | $940 |

| Contribution per Episode | $1,060 |

| Break-Even Episodes/Month | 8 |

Loan Repayment

- Loan Amount: $100,000

- Lender: First Citizens Bank – Healthcare & Professional Services Lending

- Interest Rate: 6% annually

- Loan Term: 10 years

- Repayment Start: Year 2

- Year 1: Interest-only payments

- Years 2–10: Principal and interest payments

| Loan Item | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 |

|---|---|---|---|---|---|---|---|

| Beginning Balance | $100,000 | $100,000 | $82,000 | $64,000 | $46,000 | $28,000 | $10,000 |

| Principal Payment | $0 | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 | $10,000 |

| Interest Payment (6%) | $6,000 | $5,500 | $5,000 | $3,840 | $2,760 | $1,680 | $600 |

| Total Debt Service | $6,000 | $23,500 | $23,000 | $21,840 | $20,760 | $19,680 | $10,600 |

| Ending Balance | $100,000 | $82,000 | $64,000 | $46,000 | $28,000 | $10,000 | $0 |

The loan is structured as a 10-year SBA 7(a) term loan. Financial projections assume accelerated principal repayment based on available operating cash flow, resulting in full payoff by Year 7. This reflects conservative debt management rather than a required loan term.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.