Thinking of starting your own call center company? Great idea!

But before you pick up the phone (literally), you’ll need a solid business plan that helps you figure out: Who your ideal clients are? What services will you offer? How will you stand out in a crowded market?

Without knowing these, you’ll be running your business on guesswork.

Don’t worry if you don’t know how to write one for your business. In this call center business plan template, we’ll walk you through each section you need to convey your information and convince your investors.

Why do you need a call center business plan?

A call center business plan helps you define your service model (inbound, outbound, blended), target industries, pricing strategy, staffing structure, and technology setup. It lays out how you’ll attract clients, manage high call volumes, maintain service quality, and grow profitably.

It also helps you forecast operational costs—like agent salaries, software licenses, and telecom expenses—and match them against realistic revenue expectations.

Whether you’re pitching to investors, applying for funding, or simply trying to scale smartly, your plan proves you’ve thought through every detail of delivering consistent, high-quality customer support.

How to write a solid call center business plan?

Follow this step-by-step guide to writing a call center business plan:

1. Executive Summary

The executive summary is a brief overview of your entire call center business plan. It presents the key insights from your plan in a way that sparks interest and encourages readers—especially potential investors or lenders—to read further. Hence, keep it sharp, focused, and engaging.

A well-crafted executive summary answers the most important questions a stakeholder might ask before funding or supporting your call center company.

So, try to cover all these key elements in your plan summary:

- The main objective of your call center business

- The customer problems you’re solving

- The services your call center will provide

- Your target audience

- Your marketing and client acquisition strategy

- The financial highlights

As you start writing, remember that the executive summary should summarize your business plan and highlight all the essential aspects—not just the business idea.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $14/month

2. Company Overview

This section gives a quick yet clear snapshot of who you are, what you do, and where your call center business is heading.

Start by stating your business structure—whether you’re a sole proprietorship, LLC, or corporation—and mention your operational model (on-site, remote, or hybrid). Include your location, service regions, and any relevant compliance standards you’ll meet.

Briefly describe your core offering. Are you a multilingual outbound call center? A 24/7 inbound call center support hub for healthcare or fintech? Clarify your niche and what sets you apart.

Further, add a short backstory—why you started this call center and what industry gap you’re filling. Maybe it’s about solving high wait times or providing cost-effective, high-quality customer service.

Wrap up with a quick vision and mission statement to highlight your purpose and long-term direction. For example:

Vision Statement

“To be the most trusted voice behind every brand—delivering service with speed, empathy, and excellence across every channel, every time.”

Mission Statement

“We empower businesses to connect with their customers through reliable, scalable, and human-centered support solutions. By combining smart technology with trained professionals, we ensure every call, chat, or message drives satisfaction and loyalty.”

3. Market Research

The market research section paints a clear picture of your ideal clients, a call center industry analysis, and your competitive landscape. This is your opportunity to validate the potential success of your call center by showing there’s real demand for your services and room for growth.

While planning this section, you must include:

Market Share, Growth Potential, and Industry Trends

Start by identifying the Total Addressable Market (TAM) for your call center. Are you targeting small and medium businesses, large enterprises, startups, or specific sectors like healthcare, e-commerce, or tech support?

Use credible industry data to show how the BPO (Business Process Outsourcing) and customer support industry is growing—mention trends.

Estimate your growth potential by narrowing it down to a Serviceable Available Market (SAM) and explain what portion of that you aim to capture in your region or niche.

Target Market

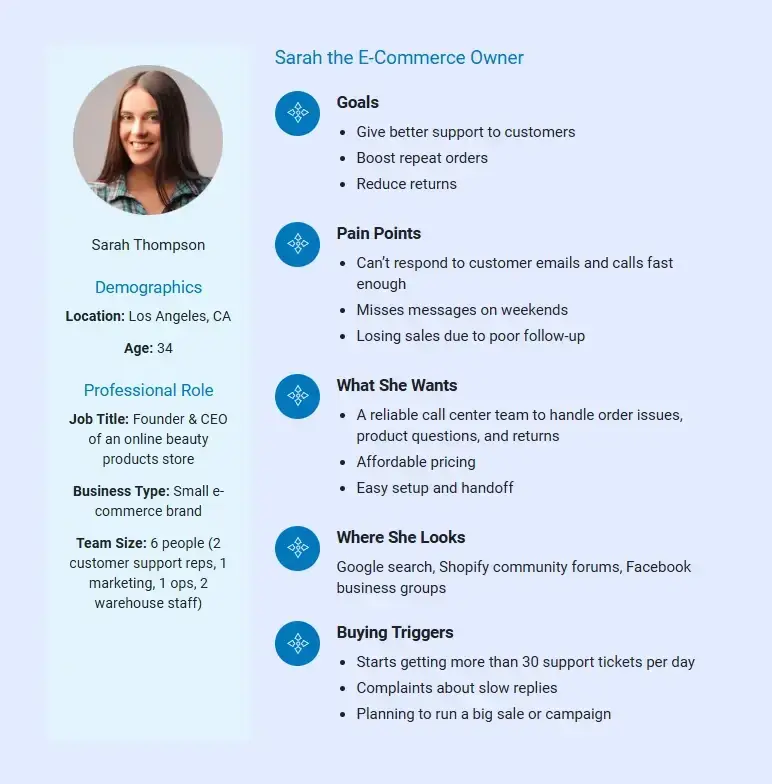

Who are your ideal clients, and what do they struggle with? Break it down by:

- Demographics (e.g., startups with 10–100 employees, mid-sized businesses in the US, etc.)

- Psychographics (e.g., looking for affordable customer service representatives, tired of low-quality outsourced solutions, wanting faster response time, etc.)

This is where you define your buyer persona to understand your target customer.

The more detailed your understanding, the stronger your marketing and positioning will be.

4. Competitor Analysis

The competitor analysis section examines how your business fits into the competitive landscape of the wine industry.

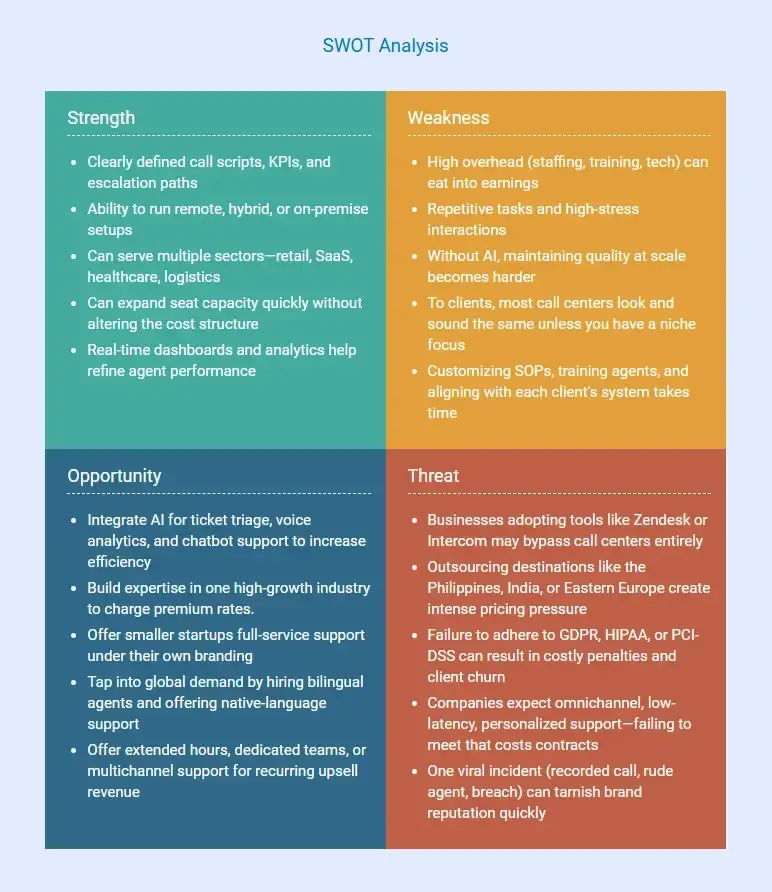

It helps you identify direct competitors, market trends, and opportunities and evaluate where your business stands and how you can leverage your strengths to gain a competitive advantage.

Start by identifying the top 3–5 competitors offering similar services in your region or niche. These might include large BPOs, local call centers, or even virtual assistants offering customer support.

Also, highlight your competitive advantage. Maybe you offer a faster onboarding process, industry-specific trained agents, or better technology integration.

You may even conduct a SWOT analysis to assess both internal strengths and weaknesses as well as external opportunities and Threats in the market.

5. Services Offered

Here’s where you get specific about what your call center actually delivers. “Customer support” or “telecalling” can mean a lot of things, so be crystal clear.

Are you an inbound call center only, or do you also run outbound campaigns? Are you focused on technical support, appointment scheduling, customer care, or all of the above?

This section should clearly lay out what clients can expect from your services—and how those services solve real business problems.

Here are a few key elements you may consider including in this section:

- Your core services

- Value-added services

- Service delivery models

- Types of call center models

- Pricing strategies

The more grounded and specific you are, the easier it is for clients, partners, or investors to see the real value you bring to the table.

6. Marketing Strategy and Implementation

The call center industry is highly competitive as businesses constantly seek faster, more efficient, and cost-effective customer support solutions.

To stand out, you’ll need a clear and actionable marketing strategy that not only reaches your ideal clients but also builds long-term relationships.

Here’s how to approach your marketing strategy for a call center business:

- Begin with your marketing goals: Start by identifying the primary objectives of your marketing efforts. Are you aiming to generate inbound leads, book demo calls, or secure contracts with mid-sized enterprises? Be specific.

- Define your ideal clients: Briefly describe who your marketing is targeting. Include business size, industry (e.g., eCommerce, SaaS, healthcare), location, and typical support needs.

- Describe your conversion approach: Explain how you’ll turn interest into clients. Will you offer a trial period? Use live demos or proposal calls? Mention what the client journey looks like from first contact to contract.

- Touch on retention and upselling: Briefly mention how you’ll keep clients satisfied and loyal—like through regular reporting, check-ins, or performance reviews—and how you plan to increase contract value over time.

7. Operations Plan

The operations plan explains how your call center will run on a day-to-day basis to deliver consistent, high-quality support experiences for your clients.

To plan this section effectively, try to cover all the operational intricacies, starting from staffing requirements and technology to quality control and regulatory compliance.

First, outline your staffing structure and agent workflow. Will your agents work in-house, remotely, or through a hybrid setup?

Detail how you’ll recruit, train, and manage your team to ensure they’re aligned with client expectations and service standards.

Next, describe the tools and technologies you’ll use to manage call routing, customer interactions, and performance tracking. This could include:

- Cloud-based call center software

- CRM integrations

- Ticketing systems

- Dashboards for real-time monitoring

Then, explain how you’ll handle quality assurance and performance evaluation. Mention procedures like call monitoring, feedback loops, and regular training sessions to maintain service quality and improve agent skills.

Also, address how you’ll manage scalability and shift scheduling. Highlight how you’ll manage when the business scales up, like client growth, seasonal surges, or multi-time-zone coverage.

Finally, cover data security and regulatory compliance. Outline how you’ll comply with laws and implement secure communication protocols.

8. Management Team

This management team section is your chance to show that your call center isn’t just an idea—it’s backed by capable leadership who can make it happen.

Whether you have a full team or just key roles mapped out, here’s how to write it in a structured, effective way:

Step 1: Start with the founder(s)

Include a short professional background that highlights experience relevant to the call center space—such as managing large teams, working in customer service, or leading operations.

Step 2: List key leadership roles

Outline the core roles that will run your business day to day. Mention the existing roles that are critical to success and explain future hiring scopes.

Step 3: Emphasize strengths, not just names

Focus on what the team brings to the table—not just who they are. Rather than just listing titles or credentials, explain how each person (or planned hire) contributes to business growth and execution.

Step 4: Keep it focused and forward-looking

Conclude the section by tying your team to your future goals. Show that the leadership structure is designed to support growth, scale operations, and adapt to market demands.

Make this section clear, strategic, and tailored to your business model. Don’t overcomplicate it with long bios—stick to relevant leadership experience, team roles, and how the team will drive the business forward.

9. Financial Plan

The financial plan outlines how your call center business will earn, spend, grow, and sustain over time. In fact, it’s what investors, lenders, and partners look at to evaluate risk, profitability, and return potential—so accuracy and clarity are key.

This will help you show a detailed blueprint of your call center’s financial aspects and the strategies you’ll use to reach your long-term goals.

Here’s what to include in a solid financial plan for a call center business:

- Startup costs

- Operating expenses

- Revenue projections

- Profit & loss statement

- Balance sheet

- Break-even analysis

- Tax considerations

In addition to these key aspects, you can enclose your risk mitigation strategies to overcome potential challenges. This shows potential funders that you’ve thought through different scenarios and are ready to run a successful call center.

To make your financial plan more compelling to investors, you can add visual charts, easy-to-understand tables, and clear reports. Refer to the examples mentioned below for more clarity:

Income Statement

| Category | 2024 | 2025 | 2026 |

|---|---|---|---|

| Revenue | |||

| – Retainer Contracts | $350,000 | $402,500 | $462,875 |

| – Project-Based Work | $45,000 | $51,750 | $59,512 |

| – Add-on Services | $20,000 | $23,000 | $26,450 |

| Total Revenue | $415,000 | $477,250 | $548,837 |

| COGS | |||

| – Agent Salaries | $180,000 | $189,000 | $198,450 |

| – Telecom & Software | $27,000 | $29,000 | $31,000 |

| Total COGS | $207,000 | $218,000 | $229,450 |

| Gross Profit | $208,000 | $259,250 | $319,387 |

| Operating Expenses | |||

| – Office & Utilities | $28,800 | $30,000 | $31,200 |

| – Marketing & Sales | $12,000 | $13,000 | $14,000 |

| – Management & Admin Salaries | $85,000 | $90,000 | $95,150 |

| – Other (Training, Legal) | $16,200 | $17,600 | $19,200 |

| Total Operating Expenses | $142,000 | $150,600 | $159,550 |

| Operating Profit (EBIT) | $66,000 | $108,650 | $159,837 |

| – Net Other Expenses | –$1,500 | –$1,300 | –$1,300 |

| Profit Before Tax | $64,500 | $107,350 | $158,737 |

| – Tax (20%) | –$12,900 | –$21,470 | –$31,747 |

| Net Profit | $51,600 | $85,880 | $126,990 |

Cash Flow Statement

| Category | 2024 | 2025 | 2026 |

|---|---|---|---|

| Cash Flow from Operating Activities | |||

| Net Profit After Tax | $51,600 | $85,880 | $126,990 |

| + Depreciation & Non-Cash Expenses | $8,000 | $6,000 | $7,000 |

| + Changes in Working Capital | –$11,600 | –$10,000 | –$12,000 |

| Net Operating Cash Flow | $48,600 | $81,880 | $121,990 |

| Cash Flow from Investing Activities | |||

| – Purchase of Equipment | –$8,000 | –$10,000 | –$12,000 |

| – Software & Tech Upgrades | –$5,000 | –$5,500 | –$6,000 |

| Net Investing Cash Flow | –$13,000 | –$15,500 | –$18,000 |

| Cash Flow from Financing Activities | |||

| + Owner Investment / Loan Inflow | $20,000 | $0 | $0 |

| – Loan Repayment | –$5,000 | –$5,000 | –$5,000 |

| – Interest Paid | –$2,000 | –$1,800 | –$1,600 |

| Net Financing Cash Flow | $13,000 | –$6,800 | –$6,600 |

| Net Change in Cash | $48,600 | $59,580 | $97,390 |

| Opening Cash Balance | $0 | $48,600 | $108,180 |

| Closing Cash Balance | $48,600 | $108,180 | $205,570 |

Balance Sheet

| Category | 2024 | 2025 | 2026 |

|---|---|---|---|

| Assets | |||

| Cash & Cash Equivalents | $48,600 | $108,180 | $205,570 |

| Accounts Receivable | $2,500 | $3,000 | $3,500 |

| Prepaid & Other Current Assets | $2,500 | $2,800 | $3,000 |

| Total Current Assets | $53,600 | $113,980 | $243,570 |

| Property & Equipment (Net) | $22,000 | $28,000 | $34,000 |

| Technology Assets | $8,000 | $10,000 | $12,000 |

| Total Fixed Assets | $30,000 | $38,000 | $46,000 |

| Total Assets | $106,100 | $178,980 | $289,570 |

| Liabilities | |||

| Accounts Payable | $10,000 | $12,000 | $14,000 |

| Accrued Expenses | $5,000 | $6,000 | $6,500 |

| Loan Payable (Short-Term) | $15,000 | $10,000 | $5,000 |

| Total Liabilities | $30,000 | $28,000 | $25,500 |

| Owner’s Equity | |||

| Owner’s Capital | $20,000 | $20,000 | $20,000 |

| Retained Earnings | $56,100 | $130,980 | $244,070 |

| Total Equity | $76,100 | $150,980 | $264,070 |

| Total Liabilities & Equity | $106,100 | $178,980 | $289,570 |

Make sure the numbers align with your strategy and operations. A well-thought-out financial section shows your call center is ready to succeed.

10. Funding Request (if any)

This section is all about how much money your call center needs and why you need it. So, try to keep it clear, specific, and realistic.

While drafting, you can also include a few funding sources from where you‘re planning to secure funding:

- Personal savings and partnerships

- Bank loans

- Small Business Administration (SBA) loans

- Private investors

- Crowdfunding

Moreover, discuss how you’ll use those funds, as investors want to know exactly where the money will go. For instance:

| Use of Funds | Amount (USD) | Purpose |

|---|---|---|

| Equipment & Setup | $25,000 | Computers, headsets, network setup, furniture |

| Software & Tools | $10,000 | CRM, VoIP system, ticketing tools, licenses |

| Hiring & Training | $20,000 | Recruit & train agents, supervisors |

| Marketing & Sales | $15,000 | Website, branding, paid ads, outreach campaigns |

| Working Capital | $30,000 | Cover salaries, rent, and overhead (first 6 months) |

| Emergency Reserve | $10,000 | Cash buffer for unexpected costs |

| Total Funding Needed | $110,000 |

Download a free call center business plan template

Ready to start writing your call center business plan from scratch? But need a little guidance to get it right? You’re in the right place. Download our free call center business plan template PDF to get started today.

This free template is designed to walk you through every key section of your plan—from defining your services and market to outlining your operations and financial strategy. You can also customize it to fit your business goals.

Conclusion

Now that you know how to map out your operations, define your services, target the right clients, and plan your finances, it should be much easier for you to draft your own plan.

But if writing the whole plan feels overwhelming or time-consuming, Upmetrics can be your go-to tool.

It’s an AI-powered business planning software that helps you build a clear, compelling business plan, including realistic financial forecasts. Also, it assists you in drafting investor-ready pitch decks without any stress.

So, don’t wait; start planning now!