10 Best AI Business Plan Generators (Tried & Tested) – 2026

We tested 10 AI tools that claim to write your business plan. Here's what actually works in 2026—and what doesn't.

Read more🌎 Upmetrics is now available in

English

Français

Deutsch

Español

Italian

Portuguese

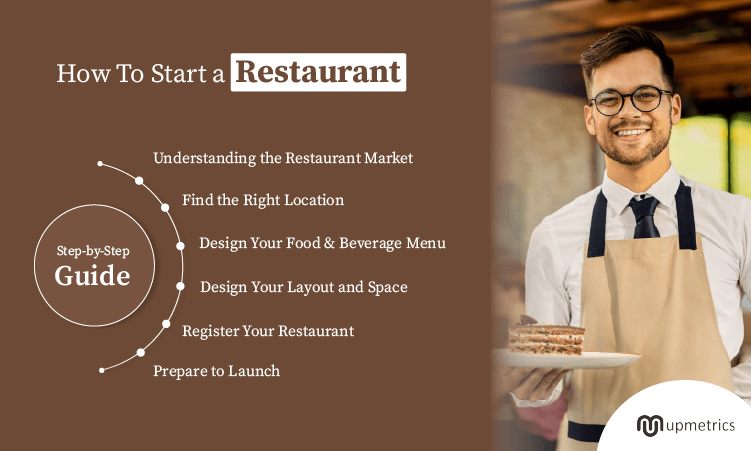

How to Start a Restaurant in (2026): A Step by Step Guide

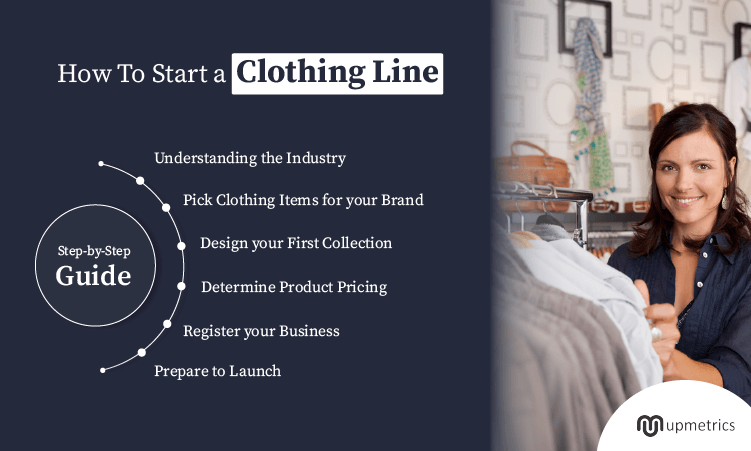

How to Start a Clothing Business in (2026): Step-by-Step Guide

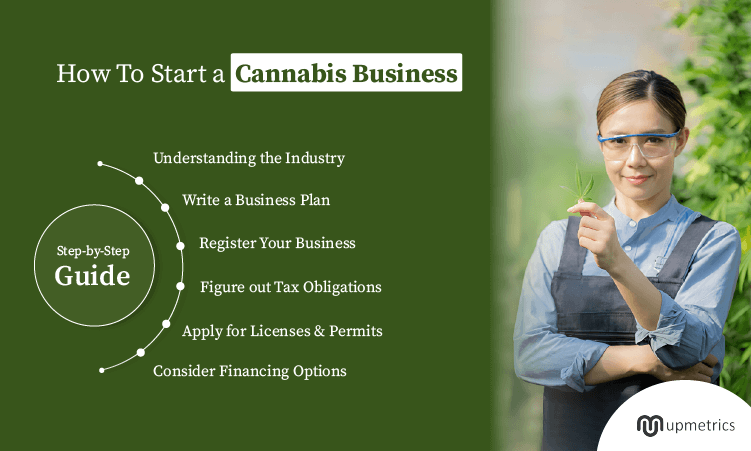

How to Start a Cannabis Business- A Step-by-Step Guide

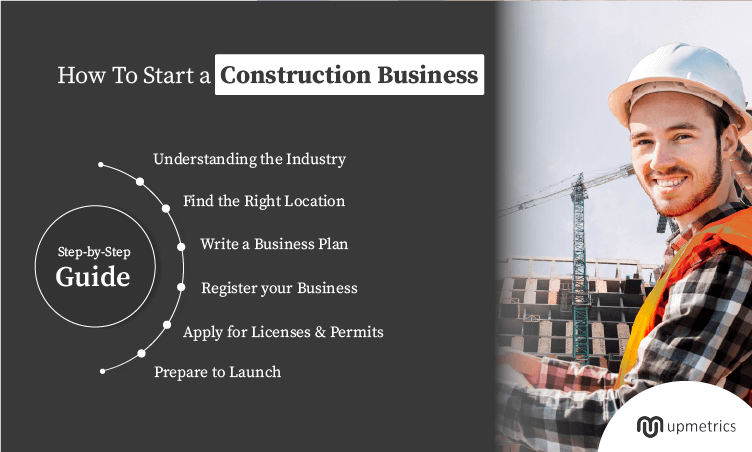

How to Start a Construction Business- A Step-by-Step Guide

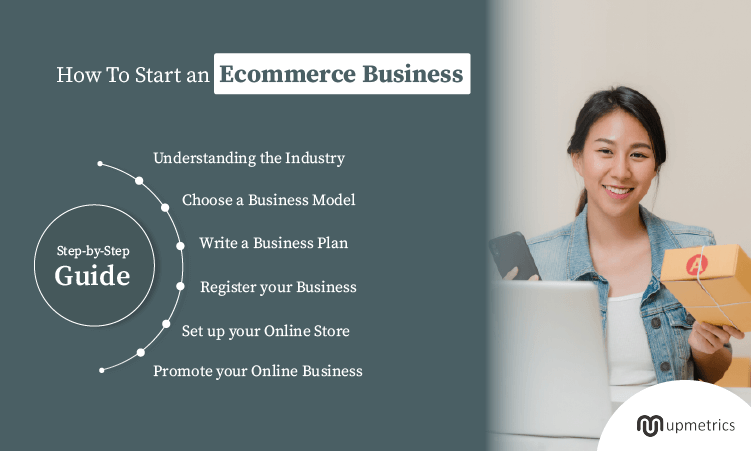

How to Start an Ecommerce Business: A Step by Step Guide

How to Start a Coffee Shop Business in (2026): Step-by-Step Guide

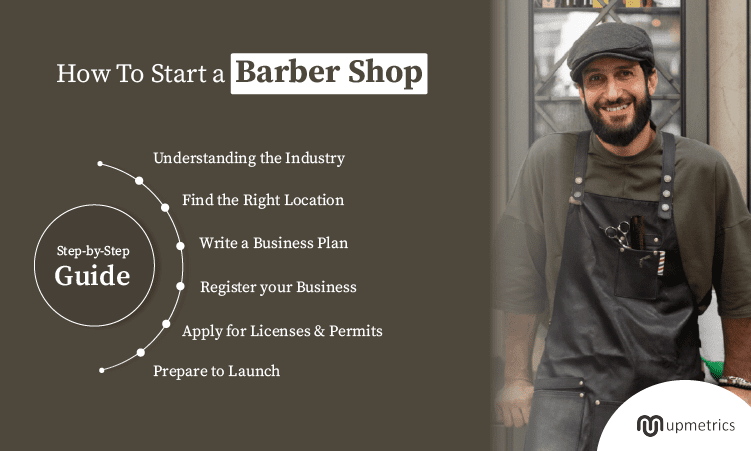

How to Start a Barbershop Business in (2026): Step-by-Step Guide

How to Start a Bakery Business in (2026): Step-by-Step Guide

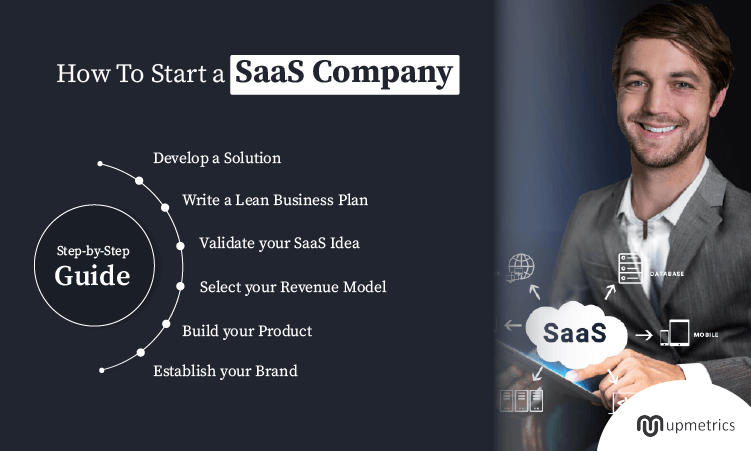

How to Start a SaaS Company (2026 Guide)

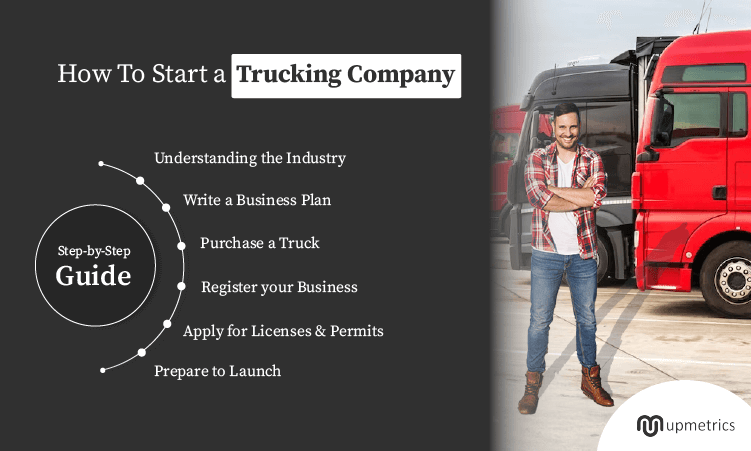

How to Start a Trucking Company Business in (2026): Step-by-Step Guide

How to Start an App Business in (2026): Step-by-Step Guide

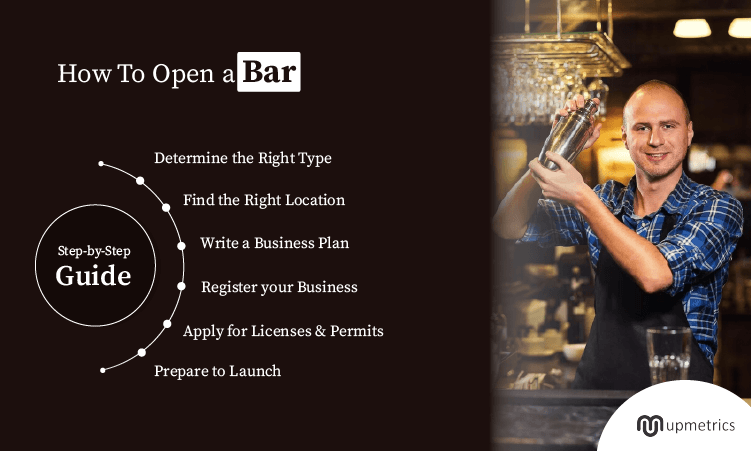

How to Open a Bar Business in (2026): Step-by-Step Guide

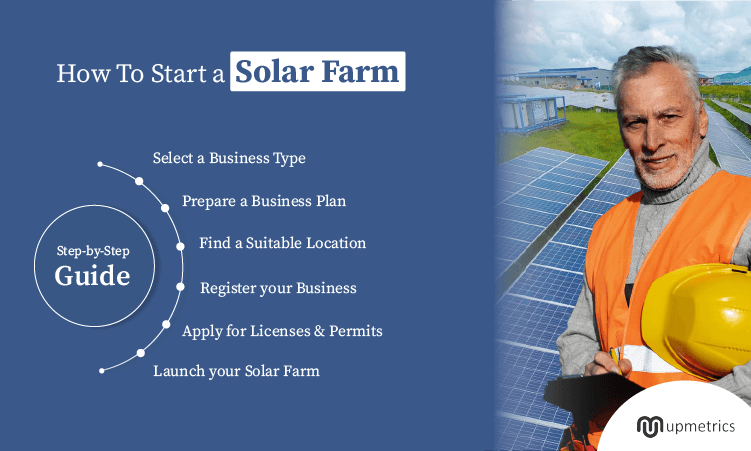

How to Start a Solar Farm Business in (2026): Step-by-Step Guide

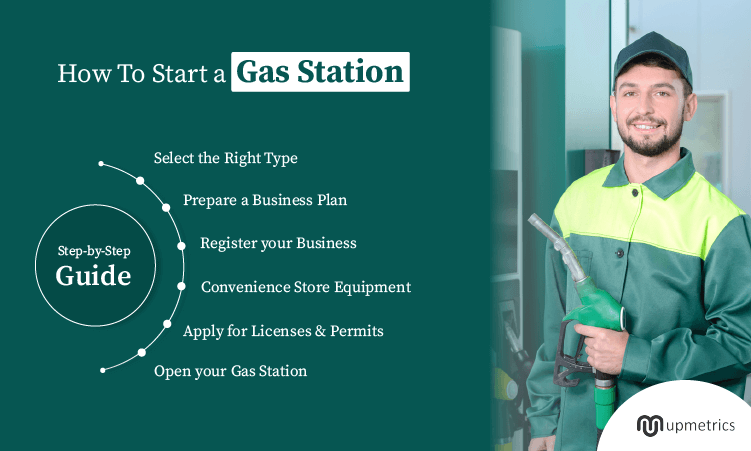

How to Open a Gas Station in (2026): Step-by-Step Guide

How to Start a Campground Business in (2026): Step-by-Step Guide

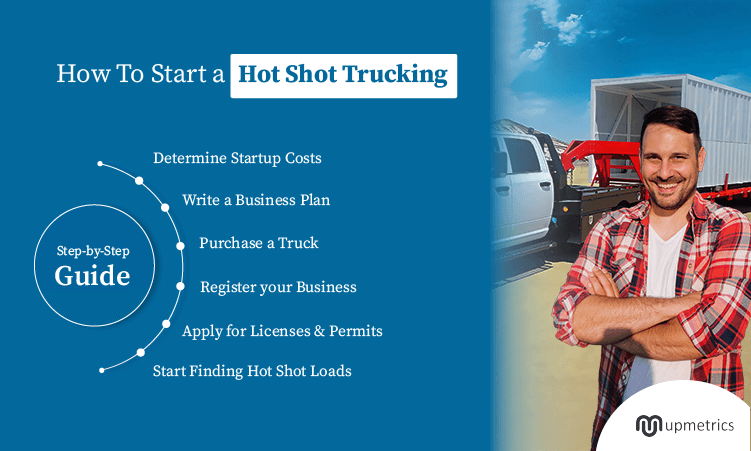

How to Start a Hot Shot Trucking Business in (2026)

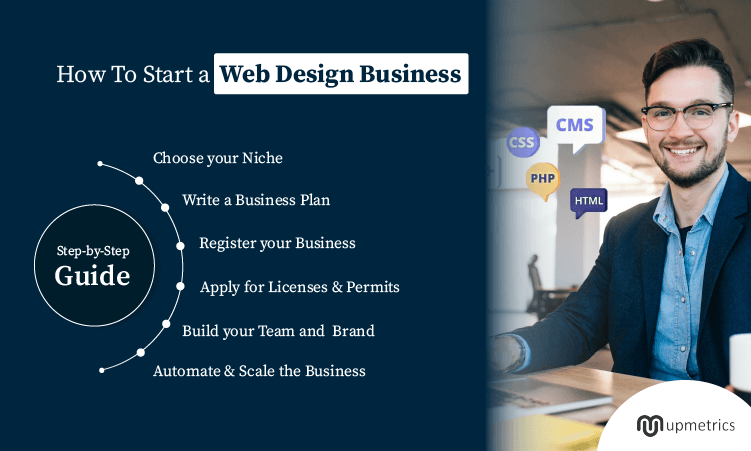

How to Start a Web Design Business

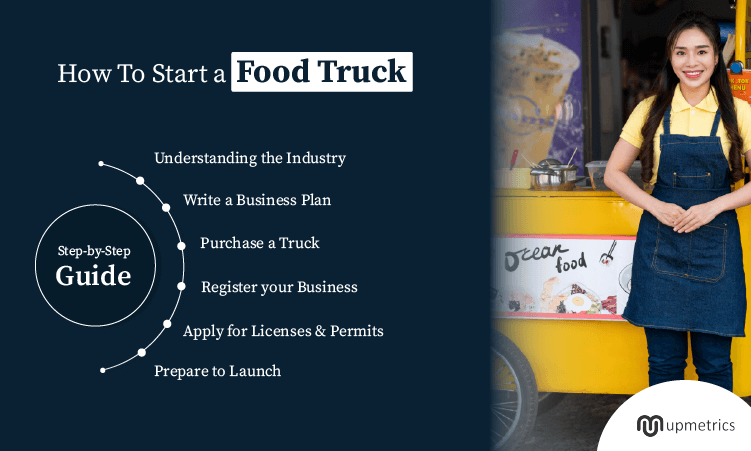

How to Start a Food Truck Business in (2026): Step-by-Step Guide

How to Start an Advertising Agency in (2026): A Step By Step Guide

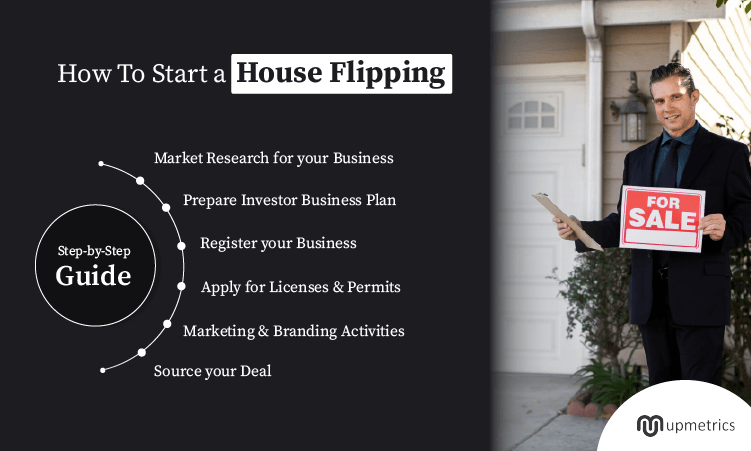

How to Start a House-Flipping Business in (2026)

How To Start a Dog Daycare Business: A Step-By-Step Guide

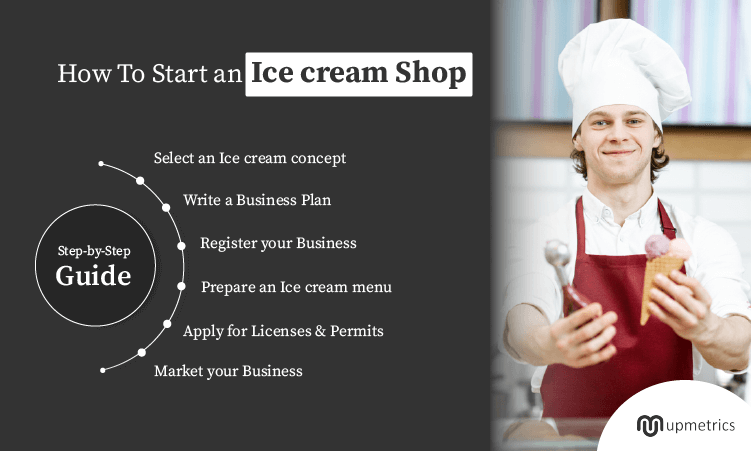

How to Open an Ice Cream Shop : A Step-By-Step Guide

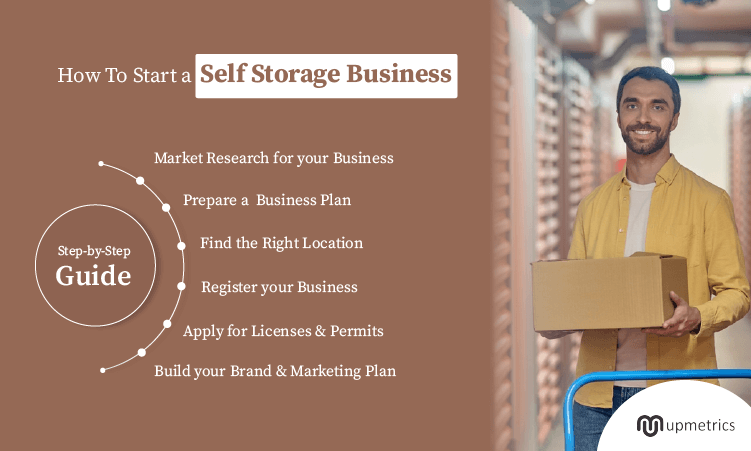

How to Start a Self Storage Business in (2026): Step-by-Step Guide

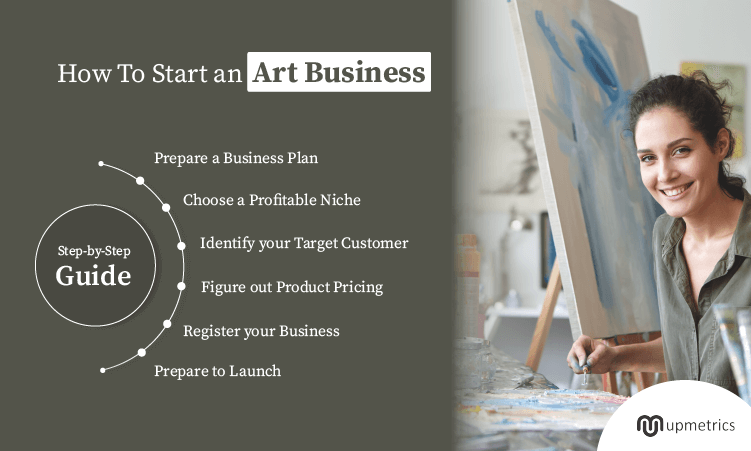

How to Start an Art Business in 2026: Step-by-Step Guide

How to Start an Event Planning Business in (2026): Step-by-Step Guide

How to Start a Junk Removal Business in (2026) in 7 Easy Steps

How to Start a Successful T-Shirt Business: 8 Key Steps and Tips

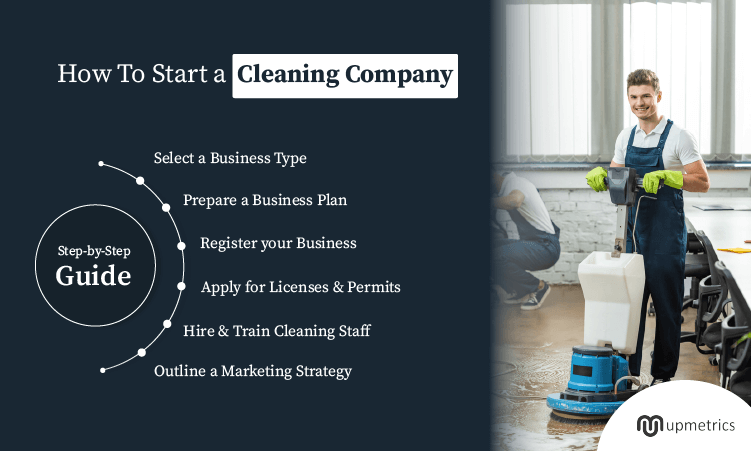

How to Start Cleaning Company Business: Step-by-Step Guide

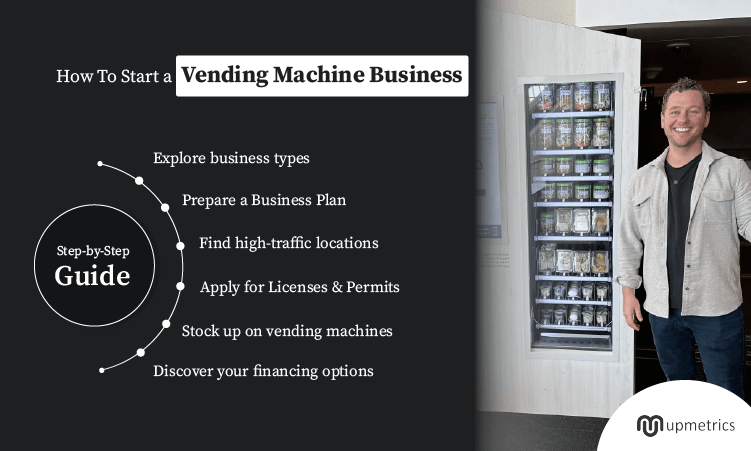

How to Start a Vending Machine Business: A Seven-Step Guide

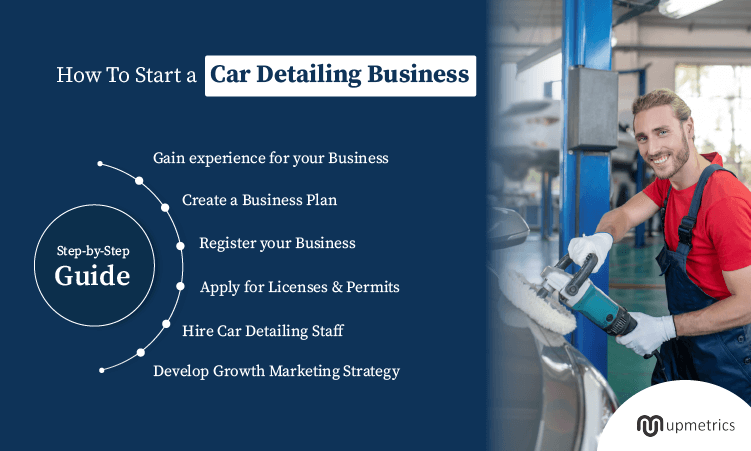

How to Start a Car Detailing Business: A Step-by-Step Guide

How to Start an Import Export Business in 9 Easy Steps

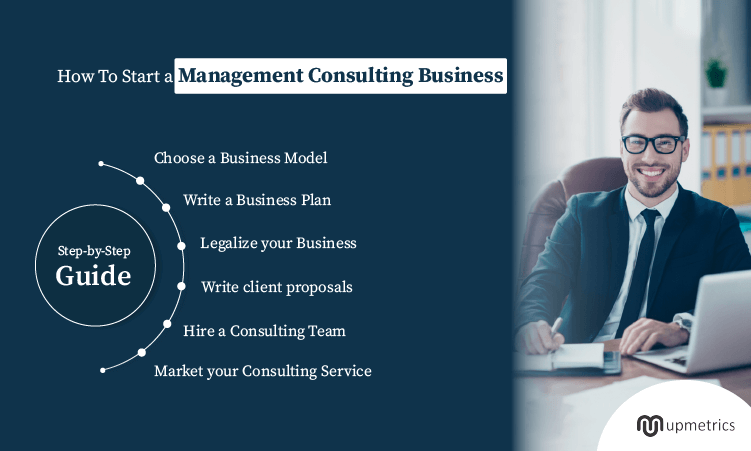

How to Start a Management Consulting Business in 9 Steps?

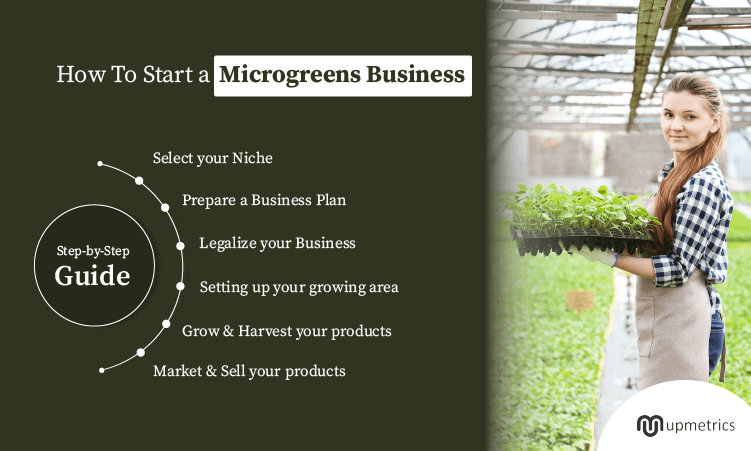

How to Start a Microgreens Business in 8 Easy Steps?

How to Start Nail Salon Business in 10 Easy Steps

How to Start a Financial Advisor Business in 8 Easy Steps

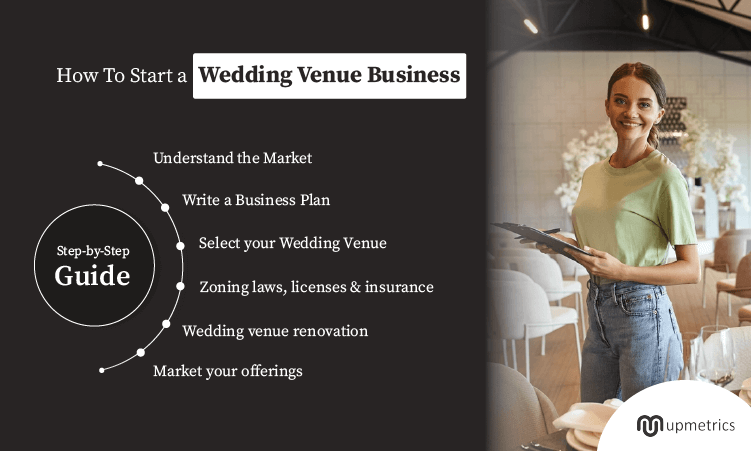

How to Open a Wedding Venue in (2026): Step-by-Step Guide

How to Open a Tattoo Shop : A Step-by-Step Guide

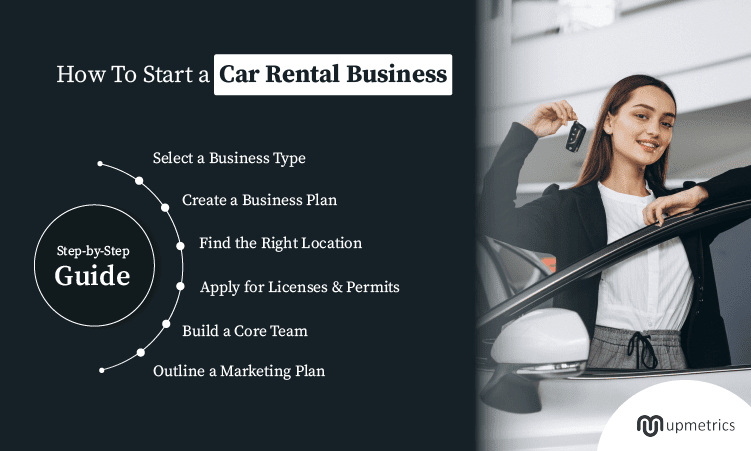

How to Start a Profitable Car Rental Business: A Step-by-Step Guide

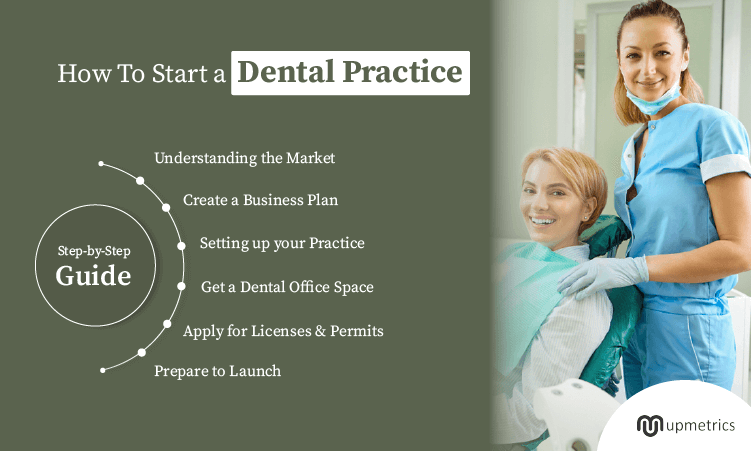

How to Start a Dental Practice in 10 Steps in (2026)?

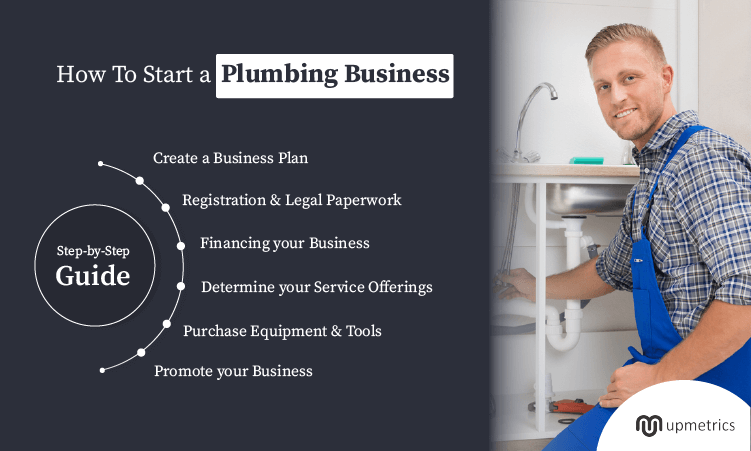

How to Start a Plumbing Business in 9 Steps

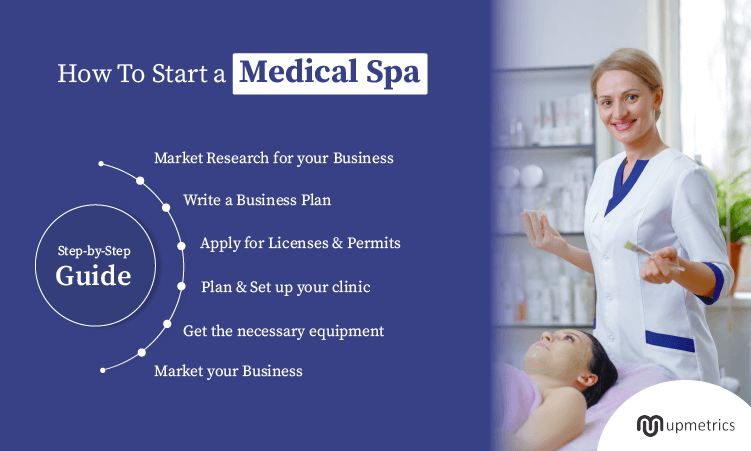

How to Open a Medical Spa Business in 8 Steps

How to Start an Auto Repair Shop: A Step-by-Step Guide

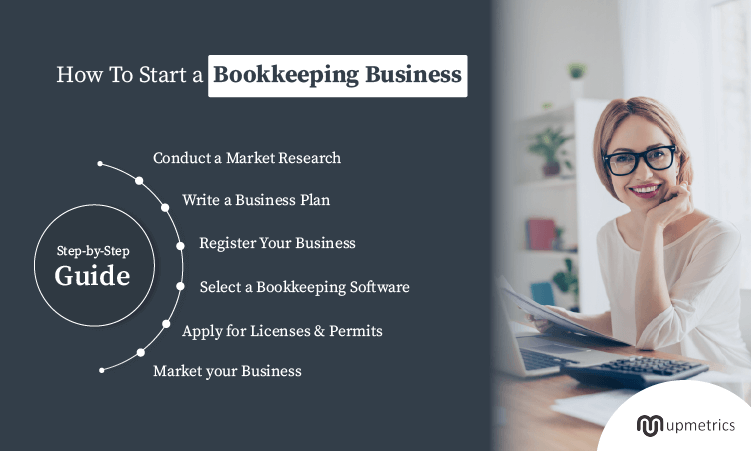

How to Start a Bookkeeping Business: A Step-by-Step Guide

How to Start a Laundromat Business: A Step-by-Step Guide

How to Start a Landscaping Business: A Step-by-Step Guide

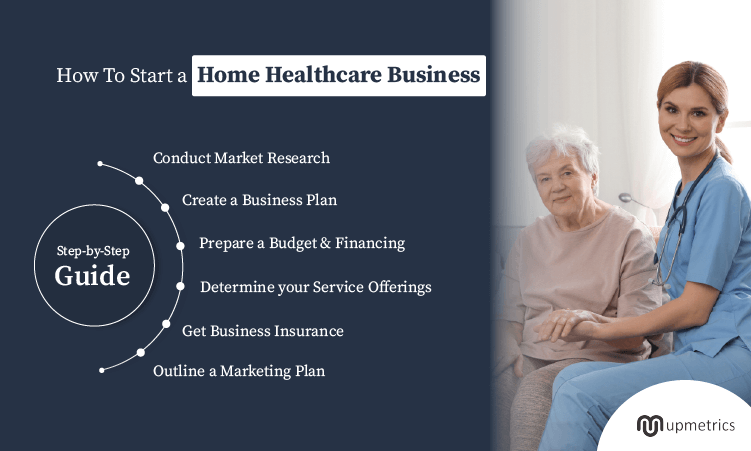

How to Start a Home Healthcare Business

How to Start an Airbnb Business: A Step-by-Step Guide

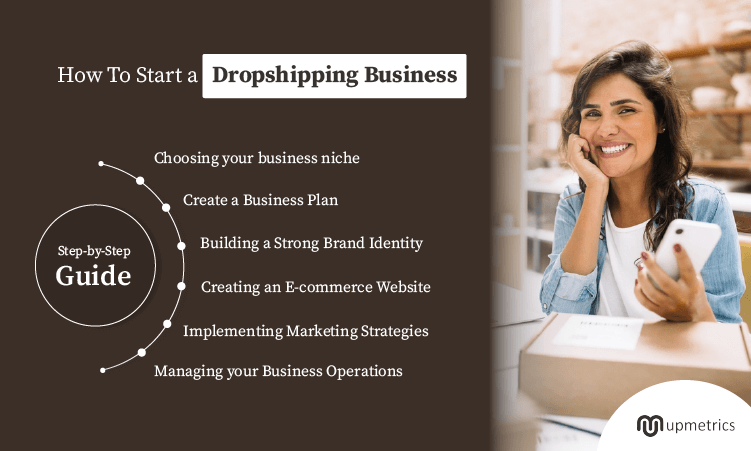

How to Start a Dropshipping Business: A Step-by-Step Guide

How to Start a Real Estate Investment Company

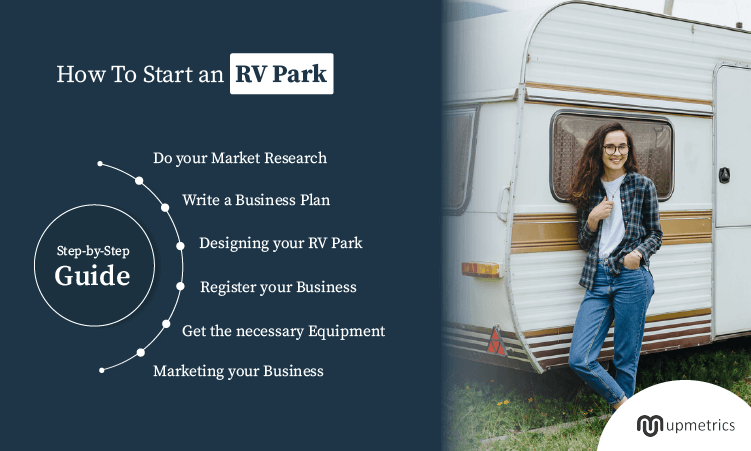

How to Start an RV Park Business: A Step-by-Step Guide

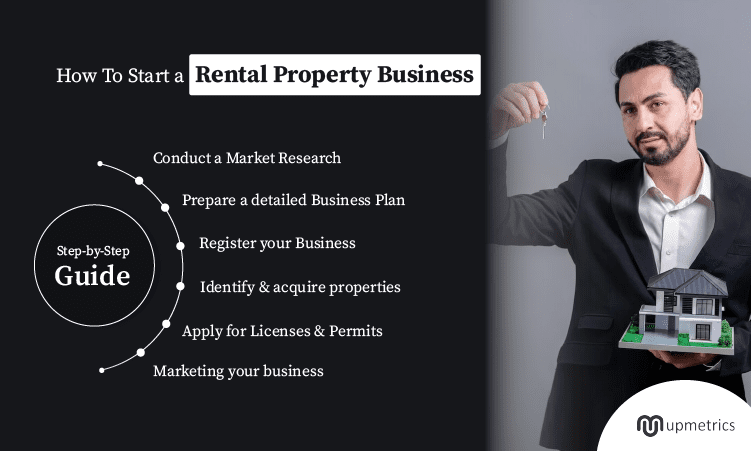

How to Start a Rental Property Business

How to Open a Yoga Studio

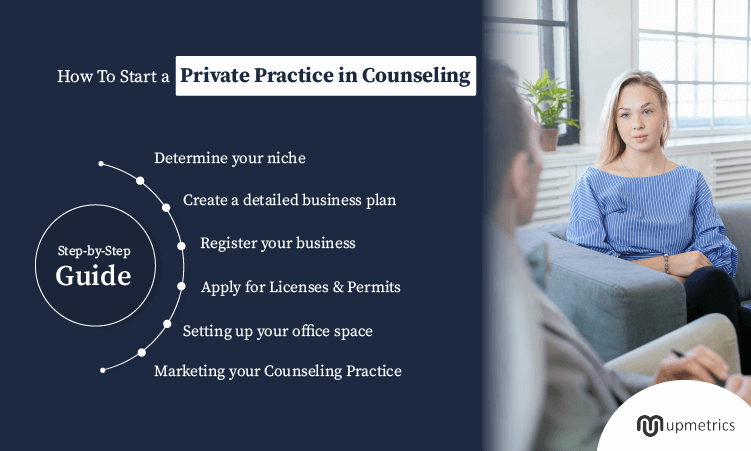

How to Start a Private Practice in Counseling

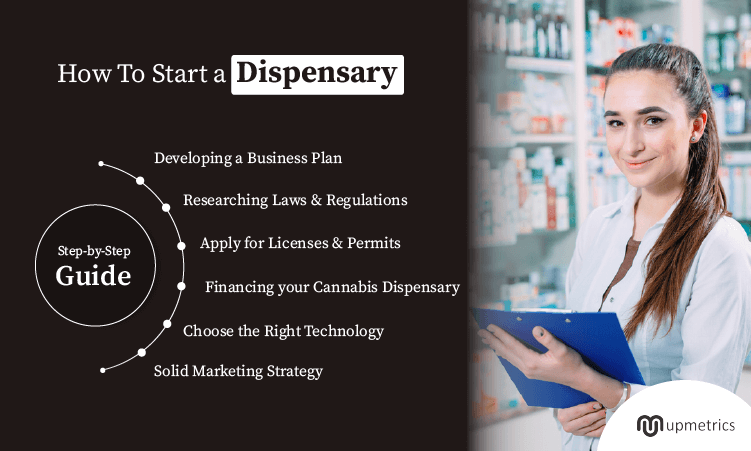

How to Start a Dispensary Business

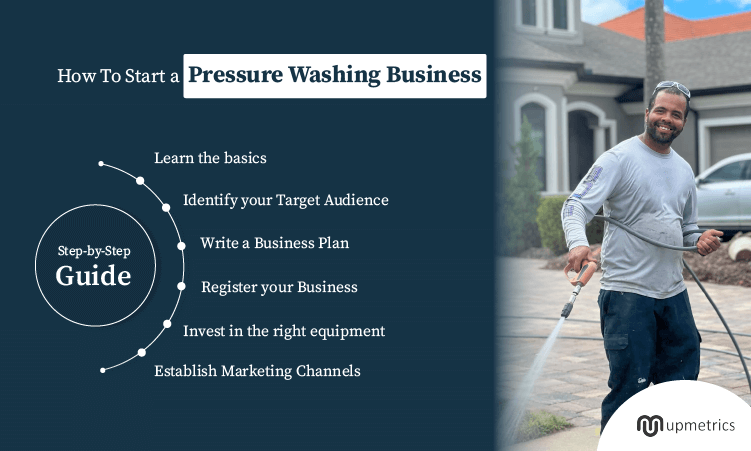

How to Start a Pressure Washing Business

How to Start a Dog Grooming Business in (2026)?

How to Start a Car Wash Business

How to Start an Event Venue Business in (2026)

How to Identify a Target Market: Explained with Example

E2 Visa Cost Explained: Government, Legal & Plan Fees

How to Start a Business in Spain: Step-by-Step Plan

Spain entrepreneur visa Guide (2026): Requirements & Process

E2 Visa Processing Time in (2026): Timelines Explained

How to Write a Business Concept (Step-by-Step Guide + Examples)

How to Start a Convenience Store (2026)

13 Effective Offline Marketing Ideas for Startups

12 Unique Business Ideas for Students

20+ Profitable AI Business Ideas to Keep In Mind In (2026)

Business Problem Statement Explained with Examples

How to Choose the Right Business Location: A Complete Strategy Guide

How to Start Cattle Farm Business – Step by Step Guide

How to Start a Tutoring Business

Business Startup Checklist: 13 Steps to Launch Your Business

How to Write Pricing Strategy for Your Business Plan

How to Achieve Product-Market Fit (PMF)

How to Start a Food Delivery Service?

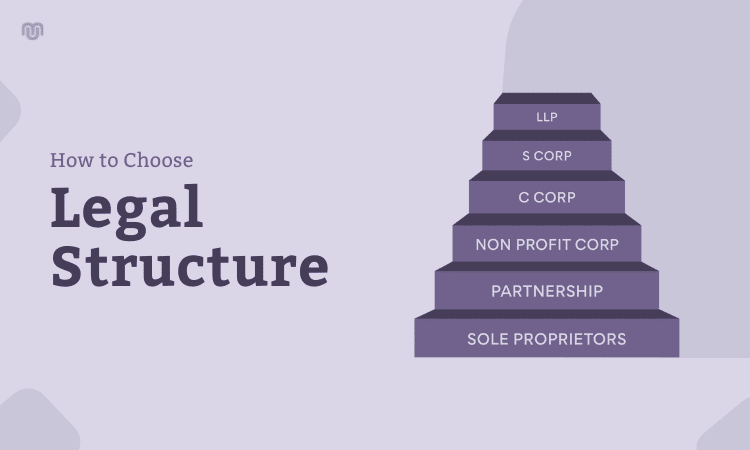

Determine the Legal Structure of Your Business

How to Find a Business Partner You Can Actually Build With

How to Start a Boutique Business: 9 Steps to Launch Right

How to Start a Catering Business

How to Start a Woodworking Business: Beginner’s Guide

The Real Reasons Why Startups Fail (Backed by Data)

How to Start a Manufacturing Business

8 Traits of Successful Entrepreneur You Should Develop

11 Most Common Reasons Why Small Businesses Fail

What is a Lean Startup Methodology: Explained with Examples

How to Start a Life Coaching Business?

How to Start a Daycare Business

How to Start Poultry Farming Business – Step by Step Guide

Guide For Business Licenses and Permits for Small Businesses

How to Start a Digital Marketing Agency in (2026)

Why Networking is Important for Small Businesses

How to Start a Business in California

Best Business Ideas in Texas to Start in (2026)

How to Set Business Goals? A Must-read Guide for Startups

Critical Business KPIs you Should Know Before Starting the Business

How To Start a Business in Florida (2026)

12 Books Every Entrepreneur Should Read Before Starting a Business

How to Start a Business in Ohio

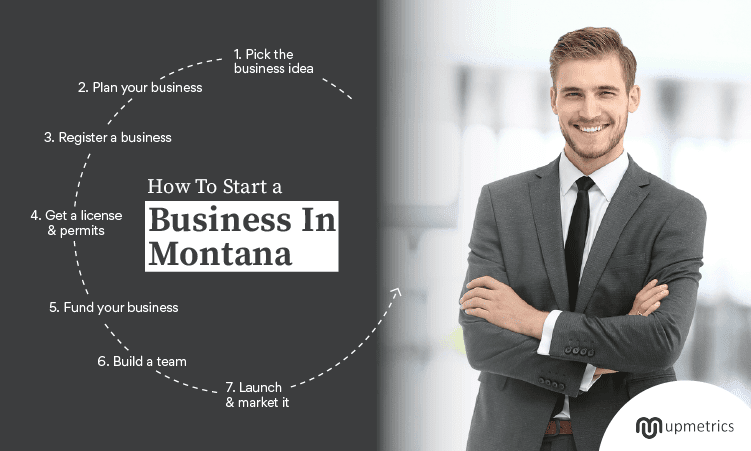

How to Start a Business in Montana

How To Start a Business in New York

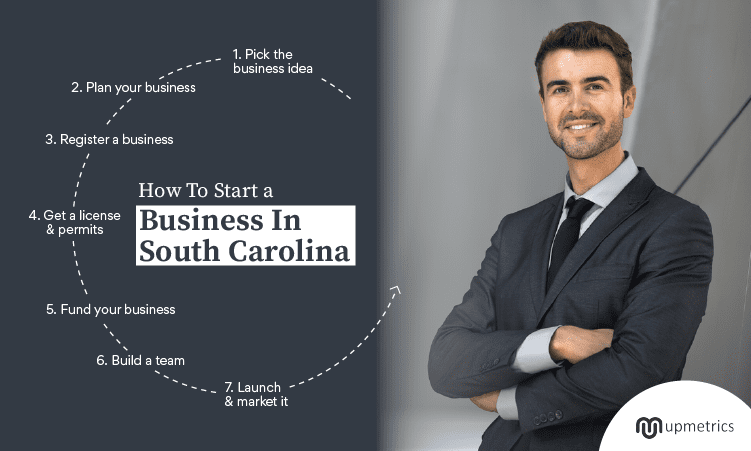

How To Start A Business In South Carolina